Africa Oil Initiation Report

- Dec 6, 2023

- 4 min read

Updated: Mar 10, 2024

This article was originally published on Twitter

I bought into Africa Oil (AOI.TO) on 4th December at C$2.55. It is a value stock and as a rule, I hate value stocks because you need to get so many things right in order to make money.

Here's why I bought-

Bank robber Willie Sutton is supposed to have said that he robbed banks because that’s where the money is.

In this environment, I have to buy value – because that’s where the money is. I have been buying a lot of value stocks of late.

In January 2020, Africa Oil revamped itself from a struggling Kenyan oil play which lost money to a Nigerian deepwater oil play which gushed cash. The company acquired a 50% interest in Prime for $519.5M, an investment that has since been fully recovered as dividends alone.

Cash dividends received from Prime:

2020 - $200M

2021 - $200M

2022 - $250M

2023 YTD dividend - $125M

Total so far - $775M

The company’s current stake in Prime has a book value of $696M.

This is from retained earnings accumulating on Prime’s balance sheet, not fresh capital injections into Prime.

Prime holds an indirect 8% WI in OML 127 and an indirect 16% WI in OML 130. OML 127 is operated by affiliates of Chevron and covers part of the producing Agbami field.

OML 130 is operated by affiliates of TotalEnergies and contains the producing Akpo and Egina fields. The three fields in these two OMLs are located over 100 km offshore Nigeria. All three fields have high quality reservoirs and produce light to medium sweet crude oil through FPSO facilities. Akpo and Egina also export associated gas which feeds into the Nigerian liquified natural gas plant, whilst Agbami associated gas is mostly re-injected.

The company also has an exploration asset with blue sky potential in Namibia. More on this later.

The company is on track to achieve 2023 guidance.

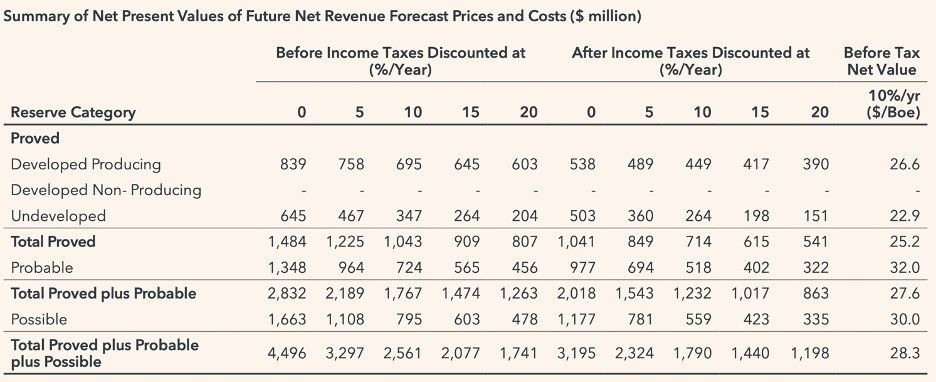

Oil wells are declining assets. Production goes down as the years go by. One measure that can be used to get a quick and dirty estimate of the remaining value of the asset is the PV-10.

This is a discounted cash flow analysis performed by an independent consultant. As of 2022, the value of the total proved and probable reserves, discounted at 10% and accounting for taxes, was $1.23B.

This does not mean the reserves ought to be valued at that price by a potential acquirer. It merely gives investors a sense of the remaining value in the asset.

In addition, Prime’s partners have greenlighted production from a new oilfield – Preowei. Plateau production of 65,000 barrels of oil per day (bopd) is expected and start-up is scheduled for 2026, with additional Contingent Resources to start up in 2028.

Africa Oil valuation

Cash and cash equivalents at the corporate level - $201.2M (no debt at corporate level)

Book value of Prime investment - $696M

Market cap - $884M (at C$2.51/share)

As much as I hate value investments, this is too cheap to ignore. And this is not even the whole story!

The game changer is the company’s investment in Impact, which discovered the Venus field offshore Namibia.

The company has an effective 6% interest in this field through its holdings in Impact (impactoilandgas.com).

Africa Oil has knocked it out of the park with two very different investments, one a cash gusher and the other a world-class discovery. I call it a value stock but there is much more to it.

If this is all common knowledge, why is the stock cheap?

Three reasons:

1. The company’s previous forays in Kenya ended in losses and investors have yet to look past that.

2. The company’s “prime” asset is in Nigeria.

3. Nobody cares about Canadian small cap oil stocks.

There’s also the overhanging threat of covert nationalization.

And the fact that it is impossible to exit an investment once you get in bed with the national oil company NNPC.

Even the mighty Exxon had to relinquish their asset when the NNPC made them an offer they couldn’t refuse.

This is why actual dividends received are so important.

A value investor with a 5+ year holding period can hope to recover his entire investment in dividends and get the upside for free. The idiots running shipping companies cater to this audience, but fortunately AOI doesn’t. The company announced a share buyback program for up to 10% of shares outstanding, starting today. At current share prices, this can be funded with less than half the cash on its balance sheet.

The company is using its cash hoard to add to its exploration portfolio and return capital to shareholders.

What’s not to like?

By ensuring there will always be a bid, the company sets a floor on how low shares can go even if all the CTAs start dumping oil futures and bidding up bitcoin or Nvidia.

This makes Africa Oil (AOI.TO) value with a catalyst – the only form of value investing I’ll touch.

Good Trading!

Kashyap

Comments