Extreme Bullish Sentiment Alert: Natural Gas

- Aug 26, 2022

- 4 min read

From Flex LNG FLNG Q2 presentation

Interesting to note that the forward curve (dotted line) constructed from exchange-traded futures contracts shows the price falling steeply by next year, presumably as more LNG storage and regasification capacity comes online and the Freeport LNG terminal gets back online. Food for thought: if Biden releasing SPR oil tamed gasoline prices this summer and ended the rally in crude, could an accelerated drawdown of European nat gas inventory end this parabolic move during/before winter season? Parabolic moves are not sustainable and when they end, they end badly.

For all the fear mongering, EU is in better shape for the winter season as compared to 2021. As demand for nat gas collapses due to high prices, at some point the inventory building stops when it becomes obvious that there just isn't sufficient demand to warrant those prices. Then the selling will start in earnest. Parabolic moves don't end in a mild and orderly correction. The setup certainly feels right for a trend change. I'm definitely starting to re-think holding on to our LNG/LPG shipping trades.

The inventory build-up has happened while pipeline supply of cheap Russian gas has collapsed. This is all high-cost inventory from LNG imports.

Put yourself in the position of the CEO of a utility company (or nat gas plant operator). You substitute cheap Russian nat gas for higher cost LNG and start charging your customers more for electricity. The electricity price goes parabolic, and you're happy you forward sold electricity and locked in an amazing profit. All good so far. Then, your customers curb their electricity demand, preferring to idle their plants than pay these unsustainable input costs (see Carlsberg and CF Fertilisers UK above). You're sitting on a sizable profit on your current inventory, but it is getting expensive to continue building inventory. There's also the risk that your retail customers will default or demand a government solution since they simply cannot afford to pay the bills, however much electricity they conserve. The demand destruction is evident, the cost of procuring more LNG is rising, and you're sitting on substantial gains on your raw material inventory. What do you do?

A nationalized utility may not have much choice but to keep running towards disaster, but every private player is for sure eyeing the exit.

Think this trend in motion will continue to stay in motion? Or meet a violent end in a matter of days to weeks?

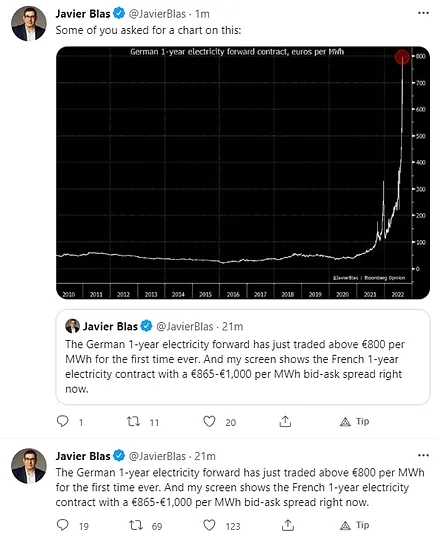

Here's the full chart. Enlarge it, make it full screen, stare at it, and tell me this doesn't end in disaster for those long these forward contracts. (Source link)

If the EU politicians want to stay in power, they're going to have to fix this. The Russian solution is coming - matter of when, not if. There is simply no alternative.

"It's Time to Start Worrying About Winter 2023/24 as This Gas Crisis Will Last Until 2025", so says Stifel. Really? Do they assume Europe miraculously avoids freezing to death this winter, but Russian gas doesn't return via pipeline, the Ukraine war drags on, the sanctions continue, the EU economy doesn't collapse, and current conditions can safely be linearly extrapolated for 3 more years? It's the morons who nod their heads to this research who are probably long German electricity futures and forward fixing LNG purchases at these prices.

An excerpt from the book Hedge Hogs, the story of how Brian Hunter blew $8 billion taking outsized long positions in natural gas futures. The trade had worked the previous year and made $1.3 billion. Mistaking a bull market (helped by Hurricane Katrina) for brains, he attempted to corner the market, buying more contracts as the price went against him. This works in futures if you can scare off the person on the other side of the trade and force them to cover. But you can only fight the market for so long. He kept pushing 2006 winter gas prices to unsustainable levels (sounds familiar?) and taking long spread positions on 2008 contracts.

The strategy was essentially an attempt to bully those traders taking the other side of his bets into covering. But the size of his trades pulled capital from other parts of the firm (Amaranth was structured as a multi-strategy hedge fund run by 12 managers, but Brian was top dog) and the losses became too big to hide. No trader is big enough to bully a $600 billion market, and the chickens came home to roost. By September 2006, the gas glut had made it obvious that the price had to come down. Amaranth tried to raise more capital from outside investors by falsely claiming to be up 25% for the year but the ploy failed. A week later, they went bust.

Natural gas futures aren't called the widow maker for no reason. The swings have always been wild. When this bubble bursts, I'll be watching for short entries in EQT, CHK, RRC, AR, SWN and GLNG.

Good Trading!

Kashyap

Comments