Monthly rollup | April 2024

- May 2, 2024

- 20 min read

Updated: May 13, 2024

Stocks Mentioned: Corn, Nutrien (NTR), Roivant Sciences (ROIV), Thungela Resources (TGA.L), Valaris (VAL), Borr Drilling (BORR), Patterson-UTI Energy (PTEN), Helmerich & Payne (HP), Nov Inc (NOV), Tetra Technologies (TTI), Liberty Energy (LBRT), MicroStrategy (MSTR), Advanced Micro Devices (AMD), Journey Energy (JOY.TO), SoundHound AI (SOUN), Super Micro Computer (SMCI), Nvidia (NVDA), Blackrock Momentum ETF (MTUM), Gladstone Land (LAND), Archer-Daniels Midland (ADM), Adecoagro (AGRO), Victoria Gold (VGCX.TO), Agnico Eagle Mines (AEM), Barrick Gold (GOLD), Eldorado Gold (EGO), Consol Energy (CEIX), Fortuna Silver (FSM), Endeavour Mining (EDV.L, EDV.TO), Uniswap (UNI), Interfor (IFP.TO), Canfor Corp (CFP.TO), Freeport (FCX), Grayscale Ethereum Trust (ETHE), Arm Holdings (ARM), Equinox Gold (EQX, EQX.TO), Gold Road Resources (GOR.AX), Centerra Gold (CGAU, CG.TO), ASML Holdings (ASML), Endeavour Mining (EDV.TO, EDV.L), Mosaic (MOS), Northern Oil and Gas (NOG), Adriatic Metals (ADT1.L ADT.AX), Nutrien (NTR), CF Industries (CF)

Highlights

Oil - first a rally, then a pause

Thungela Resources

MicroStrategy valuation is "a new norm" - BTIG analysts

Closing my position in Gladstone Land (LAND)

Buy Victoria Gold (VGCX.TO)

Buy Ethereum token Uniswap

Gold ETF Flows

Turning Bullish on Crypto

Political Risk Alert - Mali

JPY trade update

Southern Copper (SCCO)

Buy Barrick Gold (GOLD)

Buy Grayscale Ethereum Trust (ETHE)

My Trading Journey

Equinox Gold (EQX)

What are Nvidia bulls smoking?

Endeavour Mining Update (EDV.TO, EDV.L)

Meta Platforms

Bitcoin Update

The Fertilizer Trade

Sell Northern Oil and Gas (NOG)

Front Page News: The Yen Carry Trade Blows Up

Sell CF Industries (CF) and Mosaic (MOS)

Sell Fortuna Silver Mines (FSM)

Membership in the Telegram group with real-time updates is now closed. If you'd like to join, send me an email at kashyapsriram286@gmail.com

April 02, 2024

"Iceland to harvest more corn ZC_F and less bitcoin, says PM." - FT

First BC, now Iceland. Iceland's fish processing plants resorted to burning diesel over the winter as data centers hogged all the electricity. Iceland had stopped giving power for new bitcoin mining operations in 2021, so this is more of a continuation than a new policy.

Meanwhile in the land down under:

"Australia faces a looming gas shortage which could emerge as soon as next winter, and while there are marginal supply boosts that can be implemented, authorities said the chasm would be impossible to bridge by 2028 without urgent new supplies". - The Australian

The much touted Exponential Age is going to meet real world energy constraints. When food inflation and metal prices skyrocket, governments are absolutely going to favor "old economy" over "new economy" in their policy decisions.

Speaking of corn...

Fertilizer stock Nutrien (NTR) slowly working its way higher. Looking for a repeat of the 2022 run as the agriculture bull market takes off.

A bold prediction

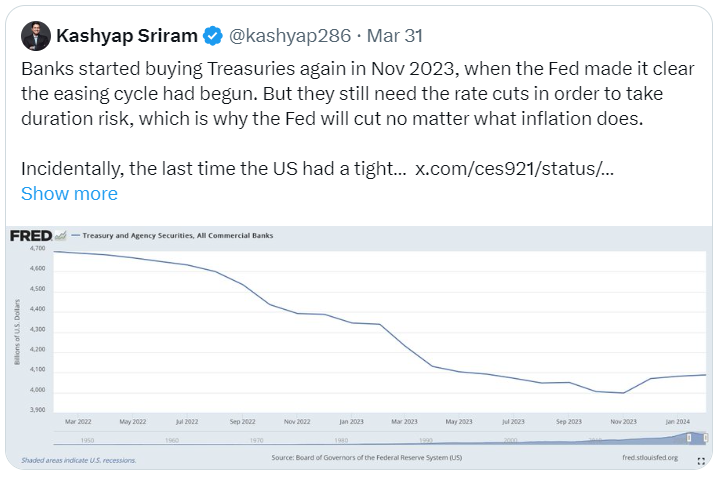

The Fed will cut rates next month no matter what happens to inflation, unemployment, ISM, or any other metric. (Note: I was wrong on this prediction).

It is an election year and that's all that matters. Tax day tends to drain liquidity from the markets. Next two weeks offer opportunities to position for lower rates (not buying bonds) and higher inflation.

Ignore rates, focus on liquidity.

Biotech Stocks

Bought my first stock in biotech today- Roivant Sciences (ROIV). One of these is not like the others.

Gold

Why is gold going up? James Rickards, writing for The Daily Reckoning, says:

"The first factor is simple supply and demand. Mining output and recycled gold have been about flat for the past eight years running between 1,100 metric tonnes and 1,250 metric tonnes per year. At the same time, central bank demand for gold has surged from less than 100 metric tonnes in 2010 to 1,100 metric tonnes in 2022, a 1,000% increase in 12 years. Central bank gold demand remained strong in 2023 with 800 metric tonnes acquired through Sept. 30, 2023. That puts central bank gold demand on track for a new record in 2023. There’s no sign of that demand slowing in 2024."

April 03, 2024

Victor Niederhoffer, James Cordier, Bill Hwang, Nick Leeson, Brian Hunter, Steven Perkins, Jim Paul, the Hunt brothers - for every great Soros/Druckenmiller story, history provides countless examples of traders who were pigs and got slaughtered.

Even with Soros, everyone remembers the Bank of England story but forgets his subsequent fx losses when he attempted to prop up the South Korean won and MYR during the Asian financial crisis.

After the Fed blew the all-clear in Nov 2023, vol selling has climbed to an extreme as pension funds and institutions reach for yield. The lessons of the XIV collapse have been forgotten.

While comparison SPX with nat gas is a stretch, 0DTE options can't clamp down vol forever.

Oil - first a rally, then a pause

Fundamentals tell me a move is coming. Technicals tell me when to get positioned (or add size, since I don't trade purely on TA). As expected, oil blasted off once it cleared $80. I think it's going to make a new range at this level as the initial spurt of momentum in the inflation trade fades.

Thungela Resources

Band squeeze breakout + meteoric rise in RSI in South African thermal coal miner Thungela Resources (TGA.L TGA.JO) . I've never owned coal stocks before and now I own two.

Something is happening in the coal sector but you wouldn't see it if you only tracked the COAL ETF.

Copper blasts higher

Copper is sensing the dollar weakness, on top of the favorable demand/supply dynamics. The Fed has to cut rates (and end QT) with a straight face and pretend rising inflation is transitory.

I've lived through high inflation in India and while I welcome the green ink in my portfolio, it is a sad time for society at large.

April 05, 2024

Oil drillers - onshore vs offshore

First Borr Drilling (BORR) and now Valaris (VAL) have announced Aramco is suspending rig contracts. Investors tend to lump all these stocks together in the oil services and equipment category but as with all cyclicals, it pays to look within the ETF.

I've rotated capital through the different sub-sectors since 2019 and right now my focus is firmly on onshore/US. Yes, I missed the big move in TDW and WFRD but I know I can't catch them all, unlike Pokemon.

I continue to favor Patterson-UTI Energy (PTEN), HP (HP), Nov Inc (NOV) and Tetra Technologies (TTI). Liberty Energy (LBRT) is the one that got away.

Corn (again)

Since I brought up corn, crude oil is up 6.7%, a Ukrainian drone hit the third largest Russian refinery, and the Middle East situation has escalated.

The Biden administration responded by suspending the SPR refill. Next steps would be a ban on exports, followed by a higher ethanol blending mandate ahead of the summer driving season.

MicroStrategy valuation is "a new norm" - BTIG analysts

BTIG ups their Micro Strategy (MSTR) price target from $780 to $1800. Not because bitcoin has gone up, or because MSTR's SaaS offering is gaining new customers.

According to these geniuses, 1 bitcoin on MSTR's balance sheet is actually worth over 3 btc because "valuation has settled into a new norm".

In effect, they are saying shares are worth more because the market has gone more mental and says the shares are worth more. By that logic, Advanced Micro Devices (AMD) PE can rise from 300x to 600x because PE increments of 100 is the new norm.

I'd love to see them value the stock of the Mississippi company.

Journey Energy

Journey Energy (JOY.TO) rising from the dead. No position yet.

A Conspiracy Theory on Gold Price Suppression

With gold taking off like a rocketship, let the crazy conspiracy theories begin.

The Great Grain Robbery is the catchy name given to a US programme that subsidized Soviet Union purchases of American grains - the Soviets purchased a billion dollars worth of grain on credit, with American taxpayers subsidizing their bill by another $300M. The episode marked the beginning of the stagflationary '70s.

Have the Chinese made a similar killing off the Comex price suppression of gold? Shanghai gold (real gold settlement) permanently trades at a premium to CME gold.

Was someone desperately trying to suppress the gold price on Dec 4th, succeeding temporarily? If so, will they try the same trick again next week? 3 am COMEX slams are well documented by the gold bugs.

Is Larry Fink promoting IBIT with the blessing of the Empire, hoping to distract the peasants with the digital gold narrative? While central banks and well-connected market participants walk off with real gold, are the pension funds and retirees being corralled into a cash creation/ redemption walled garden (which has absolutely no relation to the actual Bitcoin network)?

If you believe gold is due for a pullback, the market is frothy, the barbarous relic has no yield, it is just a pet rock, etc. buckle up - there is no fever like gold fever.

"Gold is the money of kings Silver is the money of gentlemen Barter is the money of peasants Debt is the money of slaves" - Norm Franz

The Exponential Age of the Barbarous Relic

It's The Exponential Age. Crypto is the super massive black hole that eats all other asset classes. Just look at that God candle on bitcoin.

Oh sorry, that's gold. Never mind.

If this experiment is repeated today, I imagine Mark Dice will run out of silver bars. Although the way cocoa futures are going, the Hershey bar might offer competition to silver!

April 06, 2024

USDJPY was stuck in a range all week. When this moves, it'll really move. The situation reminds me of Bruce Kovner talking about the CAD in Market Wizards.

April 07, 2024

Smaller refiners closing implies higher ton-mile demand for tankers. Coupled with NATO attacks on Russian refineries, Iranian attacks on Israeli refineries, and higher demand as stockpiles build in anticipation of US summer driving season, the catalysts are in place for a spike in gasoline prices.

The policy response will be to mandate higher ethanol blending, which is why I'm positioned long corn in addition to being long gasoline, tankers and refiners.

April 09, 2024

April 11, 2024

At this point, the only thing propping up US tech is call buying, and algos which are late to the sector rotation that's underway.

Even super bubble stocks like Super Micro (SMCI) and SoundHound AI (SOUN) (it even has AI in its name - what more do investors want?) are struggling.

The Nvidia (NVDA) frenzy has fizzled as other tech companies have figured out a way to bypass its products.

A bust, not unlike the dot com era, looms.

Fundamentals tell me which stocks to watch closely. Technicals tell me when a move is coming. It's wonderful when both align.

The Blackrock Momentum ETF (MTUM) should replace (NVDA) with Thungela (TGA.L) as their top pick.

Closing my position in Gladstone Land (LAND)

Buy Victoria Gold (VGCX.TO)

Buy Ethereum token Uniswap (UNI, Price: $9.39, MCap: $7.07B)

Closing my lumber bets for now

I had two Canadian lumber stocks Interfor (IFP.TO) and Canfor Corp (CFP.TO) in my portfolio, my only exposure to lumber. Both still offer value, but I've exited my position and rotated the capital into biotech and Chinese tech stocks.

April 12, 2024

With gold above $2400/oz, let's be honest about gold: its critics will completely miss the opportunity.

Incidentally, this article appeared in the Wall Street Journal about $50 and 5 months before gold bottomed.

Inflation

Inflation only stings if you earn less than $300k. Learn to take the bus, don't buy in bulk, have less fun and you'll be fine.

Besides, as Nobel laureate Paul Krugman has pointed out, CPI excluding food, shelter, energy, transportation and medical care is below 2%.

‘It’s one banana, Michael. What could it cost, $10?’

Well, maybe in a few more months...

Gold ETF Flows

Global physically backed gold ETFs witnessed their tenth consecutive monthly outflow in March, losing US$823M. Collective holdings fell by 14 tonnes to 3,112t by the end of March, the lowest since February 2020 and 21% lower than the month-end record of 3,915t in October 2020.

Source: World Gold Council

If you think gold has risen too much, just wait until ETF investors start piling into gold.

No fever like gold fever.

Gold Correction?

To everyone who is either calling a top or panicking over a $50 move in gold on a Friday afternoon - it helps to put the move in perspective:

"And right here let me say one thing: After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It was always my sitting. Got that? My sitting tight! Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money. ..... Disregarding the big swing and trying to jump in and out was fatal to me. Nobody can catch all the fluctuations. In a bull market your game is to buy and hold until you believe that the bull market is near its end. To do this you must study general conditions and not tips or special factors affecting individual stocks.” - Reminiscences of a Stock Operator

I'm not worried about gold.

April 13, 2024

Paxgold just spiked to $2475 (1 PAXG = 1 oz gold). The only gold market that's open 24x7 is signaling buyer's panic. Digital gold is down 4% and has failed to make a new high in a month - even with all the hype on the halving event.

No fever like gold fever.

April 14, 2024

April 16, 2024

Political Risk Alert - Mali

Barrick Gold (GOLD) is well diversified and can sustain the loss of its mine in Mali but B2Gold (BTG) certainly can't sustain the loss of its Fekola mine complex.

I'd avoid buying B2 even though it looks cheap (down 10% ytd even as other miners are up 40-50%).

I'm not too worried about Barrick taking a hit - Mark Bristow (now CEO of Barrick) led Randgold through the 2012 Mali coup and is no doubt capable of handling any situation that arises.

JPY trade update

Stopped out of the yen trade for a 2.5% loss. Short interest in the yen is at 17 year highs, the currency is at 34 year lows - has all the indications a reversal "should" happen but no arguing with this chart.

"Losing money is the least of my troubles. A loss never bothers me after I take it. I forget it overnight. But being wrong - not taking the loss that is what does the damage to the pocketbook and to the soul." - Reminiscences of a Stock Operator

Avalanche (AVAX)

I think we are about to enter the part of the crypto cycle where rational investors start evaluating projects on their merits and potential use cases, with ETF hype giving way to actual utility.

While Ethereum offers a one size fits all approach to tokenization of real world assets, Avalanche AVAX offers customization and a multi-chain solution. Unlike bitcoin, gas fees on Avalanche are burnt - built in scarcity increasing the value of the remaining coins.

Whether it is Blackrock tokenizing treasuries on ethereum, NFTs on Solana, or unique business models built on Avalanche - this space is about to get heated up.

Southern Copper (SCCO)

Bearish divergence in Southern Copper (SCCO). Volume has fallen by ~70% (!) since the move began a month ago. The company's market cap is 20% above Freeport's (FCX), even though it has 56% lower sales. The company mines 2 mlbs copper vs. FCX's 4.2 mlbs copper + 2 moz gold.

Sold my position today after buying in Jan at $84 and adding in Feb at $79.34.

Still bullish on copper but the valuation has to make some sense, and the technicals certainly don't.

Buy Barrick Gold (GOLD)

Barrick is the no.2 gold miner and it is on sale today on Mali rumors and lower Q1 production figures. The uptrend in gold looks set to continue for the long-term, which makes today's sell-off the perfect buying opportunity.

Buy Grayscale Ethereum Trust (ETHE)

The trust holds 0.00948307 ETH per share, which works out to an NAV/share of $28.92 using $3050 ethereum price. The market price is $22, representing a 24% discount. That's the equivalent of buying ethereum for $2320, an amazing deal. I don't think I need to say more

Over the past 3 days, I have been steadily selling down my Paxgold holdings to buy crypto. Focusing on Solana, Avalanche and Uniswap now. I was buying Ethereum earlier, but I stopped buying ETH since buying the Grayscale Ethereum Trust in my brokerage account and forgoing the 2% staking yield is more appealing.

With crypto, it is impossible to know whether I should slow down or accelerate my buying on these dips. I'll only be able to evaluate how I did in hindsight. The reason this space is so rewarding is because it is highly risky. Is this a sentiment washout mid-cycle, or the bear market that follows a top? No way to know!

Non-traders think buying the bottom gives them bragging rights - not true. I have a plan, a risk management strategy, and the flexibility to change my mind. I've done pretty well calling the 2022 bottom and catching the mid-2023 bottom, but as my former boss used to constantly remind me - you are only as good as your last trade.

Have a plan, manage risks, and the losses will hurt a lot less. That's the only way to play this game.

April 17, 2024

My Trading Journey

Nine years ago, I had a post-MBA career in IT sales and thought I'd give investing a whirl. I had subscribed to a newsletter that pointed out how commodities were cheap vs the SPX and made the case for buying mining stocks.

With the enthusiasm and innocence of a 25-year old, I fell for the sales pitch... and lost my shirt on small-cap TSX-V listed gold explorers and oil stocks.

But from then on, I was hooked. I switched career streams and became an equity analyst, got into crypto, got into trading, and the journey continues to this day.

I've extracted over 100x the initial tuition from the market and had an amazing and fulfilling career along the way.

Had I succumbed to Jack Bogle's defeatist philosophy, become an index investor and kept my day job, I'd still be chained to a desk working on RFPs, probably with a 60/40 portfolio that got killed in 2022 and freaking out about all those years' worth of savings lost.

Thank God I got my start in the Wild West of Finance.

Arm Holdings (ARM)

The Arm Holdings (ARM) chart is following Softbank lower. With 1.35 million shares available for borrowing on IBKR, I think the short attack is just beginning.

Equinox Gold (EQX)

Exited Equinox Gold (EQX EQX.TOO) today after buying at $4 in late Feb.

Rumors swirling that Orion Mine Finance is looking to sell its 40% share of Greenstone for $650M. Aussie miner Gold Road Resources (GOR.AX) is reported in talks to buy Orion's stake.

Why is Orion selling so close to first pour? Wouldn't they get a better price once the mine enters commercial production and can demonstrate everything is working as intended?

Orion needs to make milestone payments to Centerra Gold (CGAU, CG.TO), but it is unclear if the $650M number that's floating around is inclusive. Assuming it is, Equinox's 60% share of Greenstone is valued at $975M.

The company has an enterprise value of $2.6B and a mountain of debt + converts. Is the remaining company excl. Greenstone worth over $1.6B? Remaining mines = a mine discarded by Goldcorp in Mexico, 4 small Brazilian mines discarded by Yamana, and deep breath... a couple of small mines in California.

If Equinox makes a bid for Orion's stake, can they service the additional debt? Doubtful. They just had to amend the terms on $139.3M in converts, lowering the strike price from $7.8/sh to $6.5/sh. There's another $172.5M in converts bearing a conversion price of $6.3/sh.

In other words, the convert overhang caps any material appreciation in the share price from here on out.

The weekly chart looks beautiful. A pure technician wouldn't sell here. But as a discretionary trader using a blend of fundamentals and technicals, I absolutely would.

Ross Beaty is a legend but my capital is better off invested elsewhere.

The semiconductor bubble has burst

Netherlands based ASML Holdings (ASML), the maker of equipment used by chip manufacturers, reported a 60% quarter-on-quarter drop in net bookings. The company expects 2024 to be a "transition year" (CEO code for results will suck) but is hopeful that demand picks up in the second half.

While Loop Capital valiantly tries to prop up Super Micro Computer (SMCI) by setting a $1500 price target, the market is finally treating bad news as bad news.

When the time comes to short the AI bubble stocks, you won't want to.

April 19, 2024

Treasury General Account balance spiked from $672.5B last week to $930B this week as tax receipts flowed in. RRPs unchanged. Bank credit and deposits contracted slightly.

The mild liquidity drain caused tech stocks to tumble and yields to spike, while the inflation trade continues to run. The first two weeks of April were a great add point for inflation beneficiaries.

2023 was a terrible year for macro traders. 2024 looks more promising. I think my rolling bubbles thesis from my December outlook will play out over the course of this year.

Market Update

The up-tick rule has only been triggered on two tech stocks on my watchlist - ARM and SMCI. This tech sell-off was triggered by long liquidation. Short interest will take a while to come back.

April 22, 2024

I can understand the mainstream media obsession with interest rates - if your audience is small business owners or ordinary folks with a floating rate mortgage, rates are a top of mind issue.

I can even understand financial media focusing on the walking parade of Fed officials and their ever changing views on rates and inflation - 12 people giving speeches on a near-daily basis makes for a lot of headlines. Reporting can replace journalism when there's so much content.

What I don't get is money managers focusing on rates, debating whether it will be "higher for longer", and following the CME FedWatch tool on a daily basis.

A proper macro framework and a weekly glance at the liquidity data provides actionable intel - listening to Fed speeches on a day-to-day basis is just noise.

Obsessing over rates while ignoring the bond market, bank balance sheets, the dollar, commodities, and liquidity flows is a colossal blunder. More so when Jerome Burns has clearly stated he will cut rates well before inflation gets to 2% - and that 2% is a target that will only be achieved after he leaves office in 2026.

What are Nvidia bulls smoking?

Nvidia (NVDA) reported $47.5B in data center revenue in FY24, a 217% YoY increase. Assume that growth continues, but be conservative and project a "mere" 100% increase and ka-boom - you have a $95B forecast for data center alone, or ~$110B in total revenue.

To put that number in perspective, Taiwan Semiconductor (TSM) - which has to manufacture the GPUs - will report less than $80B in revenue this year.

Nvidia can book the incremental sale through entities such as CoreWeave and Lambda, which rely on debt to buy the chips. But there's a limit to the gullibility of bank lending departments - they aren't going to finance an extra $47.5B in such "sales".

Tencent (TCEHY) has stockpiled enough Nvidia GPUs to last a "couple more generations". Huawei, Broadcom, Microsoft, AMD have thrown their hat in the ring and are competing for AI chip market share.

Former buyers of Nvidia's product are now designing competing products.

I'd be very interested in knowing how the bulls come up with their forecasts. I'm all for linear extrapolation of the past, but at least make the numbers believable.

Endeavour Mining Update (EDV.TO, EDV.L)

Gap fill complete. The stock gapped down today on the pull back in gold. RSI is flagging. I think this is a good place to take some profits, especially with the increased position from last month. EDV is still a top 3 position for me but I am trimming here.

April 25, 2024

Meta Platforms

META analyst on SeekingAlpha: "Meta Platforms' enterprise value to EBITDA multiple of 12 is also far from excessive, which aligns with my belief that Meta Platforms is attractively priced today."

EV/EBITDA is not a relevant metric for cash generating businesses with low capex spend and little debt.

In a cyclical, capex-heavy sector (like steel or oil & gas E&Ps), where businesses have different capital structures (D/E mix) and approaches to capex (financial and operating leases, straight buy, contractors, etc.) analysts use EV/EBITDA to strip away the differences arising from accounting rules.

Even then, EV/EBITDA is a relative comparison, i.e. it is only used to compare how a company fares vs. its peer group in the space. It is not an absolute valuation metric.

Meta is falling because it is overvalued. Also, investors do not like this particular line in the ER:

"For Reality Labs, we continue to expect operating losses to increase meaningfully year-over-year due to our ongoing product development efforts and our investments to further scale our ecosystem".

If the company had instead said it is going to abandon its MetaVerse sinkhole and focus on growing cash flow (ad impressions up 20% YoY, price up 6% YoY, daily active users up 7% YoY) from the core business, the stock price would likely be up after-hours.

Investors are fed up with Zuckerberg for making money with one hand and pouring it down the drain with the other. Just kill the dead business already.

Bitcoin Update

Bitcoin is back below its Feb 29th high when I wrote this, and most altcoins are deep red. The MSTR bulls who were celebrating at $2k are now cowering and nursing their losses.

In the two weeks since I blew the trumpet on my selling, I got numerous calls every day from friends and clients asking how they should allocate to crypto since they were in mental agony over sitting on cash while the bulls were loudly proclaiming halving, moon, $100k, HFSP, etc. They were literally trying to pressure me into buying every dip.

Now that bitcoin is at 2-month lows (not 2-year lows), everyone is panicking and nobody wants to allocate. This is a mid-cycle correction and not a particularly deep one at that. I updated my Crypto Market Outlook to accumulate on April 14 and recommended buying ETHE on 16th.

FOMC Prediction

The Fed will cut rates and/or end QT next week on the pretext of curbing shelter inflation. Let's say I'm wrong. What's the downside in buying 2Y treasuries here?

Leveraged funds are record net short 2Y treasury futures (ZT_F). The positioning is lopsided. Volatility is low. There's a higher likelihood of a move higher like in March 2023 than a spike lower.

Positioning is equally lopsided in 5Y treasury futures (ZF_F).

This is an asymmetric setup. I can be wrong and hurt very little; I can be right and gain a lot. With equities throwing a tantrum, I like the odds even more.

Buy bonds, wear gold (IYKYK).

Corn

Slowly, steadily, traders are discovering corn has a pulse. Wheat has turned higher. Corn is still in stealth accumulation mode (ZC_F).

The continued momentum in commodities and the breakdown of the Mag 7 doesn't bode well for tech.

The Fertilizer Trade

My Mosaic (MOS) position got stopped out today. The stock is declining ahead of the expected poor Q1 report. The fertilizer trade has been dead money for the last 6 months. Corn and ags too. It'll change when it changes.

I'm not giving a Sell recommendation. But I'm not personally looking to re-enter since I already have my big December corn trade. I will add to my agriculture allocation once the price starts moving.

Sell Northern Oil and Gas (NOG)

The stock is at 52-week highs, which also happens to be just above the last top on the weekly chart. On the monthly, the stock is coming out of a long base which indicates we probably consolidate for a while here. This has been a good trade, time to sell and move on. There are plenty of opportunities in the market today, so I'm not keen to hold though a potential consolidation.

April 27, 2024

April 29, 2024

Front Page News: The Yen Carry Trade Blows Up

Yen speculators blowing up in real-time. This is a de-leveraging event that will have consequences for EVERYTHING. Got bonds?

Bonds should move because traders who are short the yen are also short bond futures. These are the most consensus trades in the market. All that's needed to set off a rout is a small blip higher in bonds.

Anyone remember Jan 2015 when the CHF/EUR peg broke and the franc gained 30% in minutes? FX brokers went under on that move. History repeats because no one learns their lessons.

Adriatic Metals

Congrats to the Adriatic Metals (ADT1.L ADT.AX) team for successfully transitioning Vares from exploration to first pour.

While zinc is currently in a slump, a high margin polymetallic mine in a stable, low-tax (10% corporate tax rate) jurisdiction in Europe is going to get scooped up by a larger miner soon enough.

Sell CF Industries (CF) and Mosaic (MOS)

My agriculture portfolio is getting unwieldy. I'm paring down the fertilizer bet from 3 stocks to 1 - Nutrien (NTR). Nutrien is the biggest, and once it starts moving the others will follow. No harm in holding all 3 but I'm closing the trade for this service.

April 30, 2024

From the Treasury QRA economic policy statement:

"...a new research series created by the Bureau of Labor Statistics—which has been shown to lead the CPI for primary rent by about a year—suggests an upcoming slowdown in renters' shelter costs. This quarterly series better reflects prices renters would face if they changed housing units every quarter; it grew by just 0.4 percent over the year ending in the first quarter".

The BLS created a new shelter inflation measure because the old one shows inflation is too high. Better yet, this one is a leading indicator which anticipates future decreases in CPI.

Conveniently, this was announced just a couple of days prior to the FOMC decision. RRPs up, yields down, and bonds ticking higher even though the QRA shows higher funding needs. Everyone expecting a hawkish Fed is being set up for a big surprise. The market has already priced in lower rates (and higher inflation).

Sell Fortuna Silver Mines (FSM)

As I mentioned in the Buy alert, this is not a stock I'd want to own through the entirety of the gold bull market. The company is reporting results next week, and I don't want to hold through earnings. There is no urgency to sell, but with the Fed announcement coming up tomorrow, I'm de-levering my portfolio. Fortuna is my second biggest position and I'm up 53.8%. I'm content to book the win and move on.

Good Trading!

Kashyap

Comments