Monthly rollup | August 2024

- Oct 1, 2024

- 19 min read

Updated: Oct 4, 2024

ANNOUNCEMENT: The paid newsletter now has both yearly and monthly subscription option at $1500/year and $150/month. If you've profited from my analysis, I encourage you to sign up and support my work so I can keep this going.

Stocks Mentioned MicroStrategy (MSTR), Nvidia (NVDA), Cameco (CCJ), Core Scientific (CORZ), Capri Holdings (CPRI), Costco (COST), Blackstone (BX), Danaos Corp (DAC), Gold Fields (GFI), Osisko Mining (OSK.TO OBNNF), B2Gold (BTG), Orla Mining (OLA.TO ORLA), First Quantum (FM.TO), Franco Nevada's (FNV), MARA Holdings (MARA), Talos Energy (TALO), Federal Express (FDX), Interfor (IFP.TO), Valaris (VAL), Apollo Global (APO), Super Micro Computer (SMCI)

Highlights

August 02, 2024

MicroStrategy

Shorting MicroStrategy (MSTR) is the gift that keeps giving. I'm back at it for another round.

"We continue to closely manage our equity capital, and are filing a registration statement for a new $2 billion at-the-market equity offering program". - MSTR Q2 release

Bitcoiners like to market bitcoin as an asset that doesn't constantly devalue, yet they worship MSTR which consistently devalues shares by printing up more share certificates.

Nick Leeson of Barings Bank thought he could will Nikkei futures higher by following the Martingale strategy of doubling up on losing trades. Michael Saylor has taken the same approach with bitcoin.

Barings Bank went out of business because the company couldn't print shares and sell them to gullible retail investors to cover their losses. I don't expect MSTR to go broke but the constant equity issuance dampens short squeezes and makes this a low risk short.

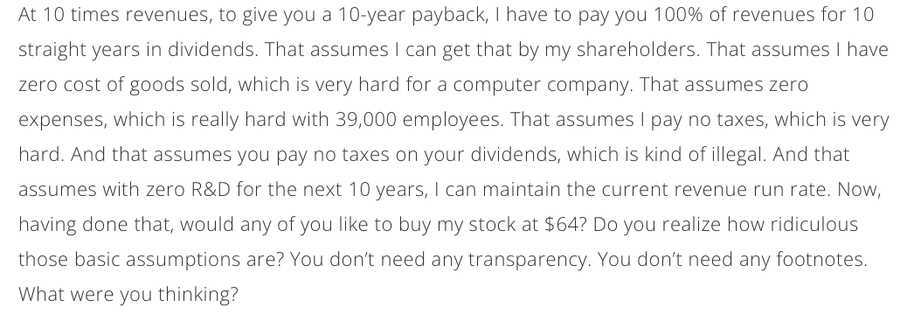

Nvidia

Nvidia (NVDA) has marketed generative AI so well that it has shot itself in the foot. The company is making acquisitions in order to buy revenue, but is getting investigated for anti-competitive practices. What happens when the investigators discover that LLMs are just vaporware in a new avatar?

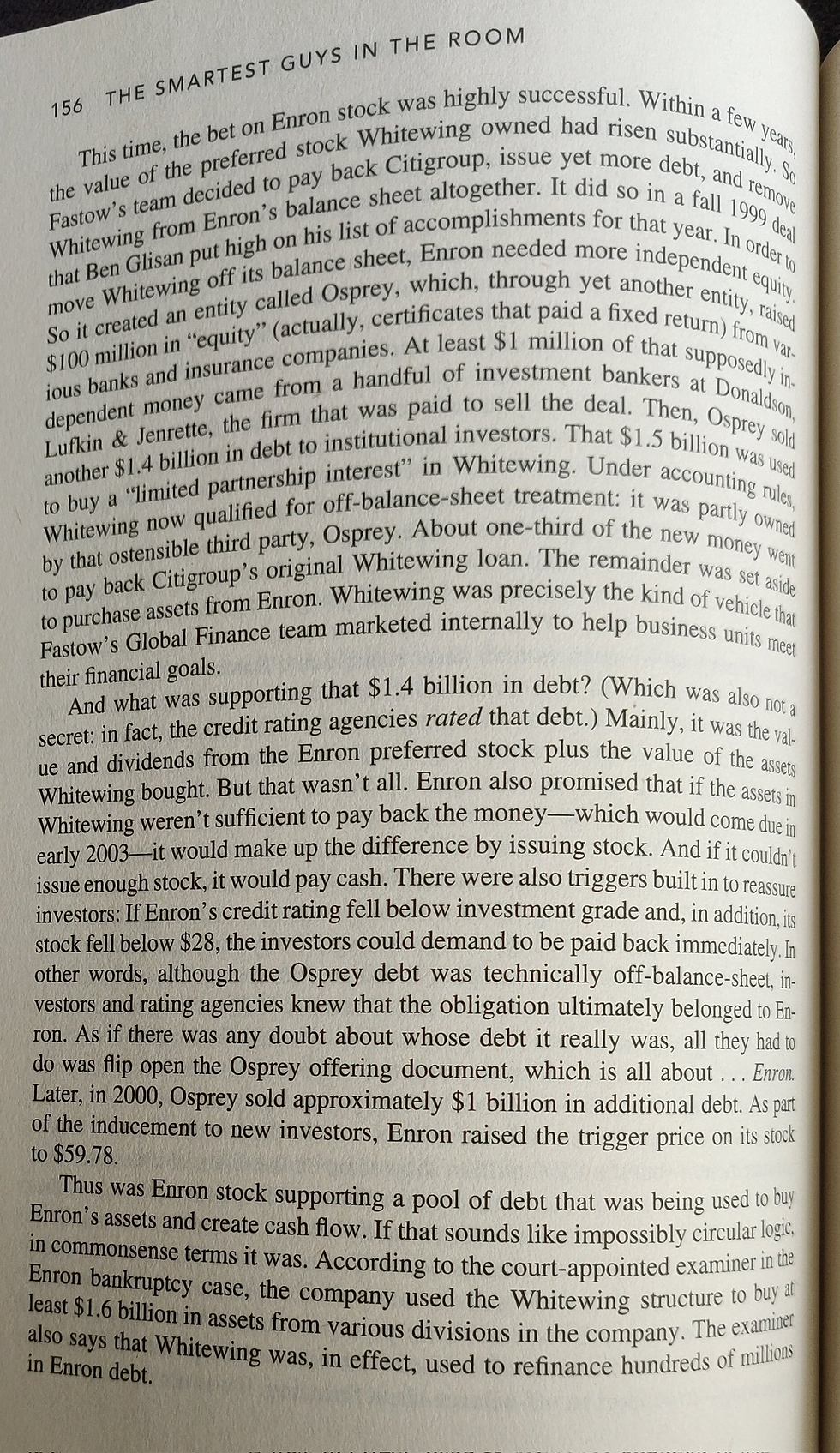

Similarities between Enron and Nvidia

Enron's use of Whitewing to rid itself of debt reminds me of Nvidia's (NVDA) use of CoreWeave and other "customers" to create revenue. Nothing like a bear market to root out all the deception and lies.

Trading a Crisis vs. Foreseeing a Crisis

A lot of smart hedge fund managers saw the GFC coming from a mile away. Some shorted homebuilders too early, and got squeezed out. Some were right on time shorting the banks, and made their nut when the crisis hit.

Then the govt stepped in and banned short selling. Just like that. They announced that all short positions in financials (plus few non-financials) had to be covered in 10 days. That ignited the mother of all short covering rallies. You could be completely right on your macro call and still end up with nothing. And many fund managers did end up in that situation.

Often, the risks in the market are the second order effects. Everyone knows the AI bubble is done and the money is now on the short side. The real risk isn't a short squeeze but something unexpected.

When the Fed, Treasury and FDIC bailed out Silly-con Valley Bank depositors, they threw out the rulebook to cater to special interests like Bill Ackman. The bailout money jump started the AI bubble, which is now bursting.

Will the tech funds on the wrong side of the trade get a bailout? After all, there's precedent - LTCM was bailed out by the NY Fed, AIG FP was bailed out by the Treasury.

If you've had a great week being short the bubble stocks, congratulations. Rather than pop the champagne, now is the time to start getting paranoid. As the 15,000 employees fired by Intel know, Only The Paranoid Survive.

This is still the best fund letter of all time. Life goals.

The PE bubble just burst

August 03, 2024

Things are breaking in the private equity la la land

"Blue Owl OWL is a leading asset manager that is redefining alternatives.

With over $192 billion in assets under management as of June 30, 2024, we invest across three multi-strategy platforms: Credit, GP Strategic Capital, and Real Estate. Anchored by a strong permanent capital base, we provide businesses with private capital solutions..."

Cameco - Lose money on every sale, hope to make it up on volume

Cameco (CCJ) Q2 results are a beaut:

Spot uranium prices averaged $87.9/lb, long-term prices averaged $78.5/lb in Q2. During the first 6 months, Cameco purchased 1.1 million pounds at an average price of $96.88/lb.

Now that I've anchored your expectations, let me tell you the price at which Cameco sold its uranium - $56.43/lb.

The supreme level of incompetence shown by Cameco's management continues to astound me.

And they haven't learnt their lesson. By 2028, the spot price could be at $140/lb and Cameco will only capture 56% of that.

Investors buy mining stocks on the expectation that FCF will grow as higher metal prices flow through to the bottom line. In Cameco's case, they will end up buying uranium at spot prices from their JV partner in Kazakhstan, and selling at below-market prices to utilities in the US.

Lose money on every pound but hope to make it up on volume seems to be the company's operating philosophy.

The Peter Principle says that people get promoted to their level of incompetence. The guys at Cameco who sign these deals have attained the nirvana of incompetence.

The URNM ETF has a 17% allocation to Cameco. I submit that they deserve a big fat zero percent.

August 04, 2024

John Perkins' Confessions of an Economic Hitman talks about what happens to third world countries when they default on their debt.

BlackRock and JP Morgan are already at work, backing a $15 billion fund to "rebuild Ukraine". A small portion of the estimated half a trillion dollars that will eventually be committed, according to the World Bank.

In exchange, Ukraine has to adopt "farmland reforms". How is this relevant to trading? Watch wheat prices.

August 05, 2024

"The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money trading…

I know this will sound like a cliche, but the single most important reason that people lose money in the financial markets is that they don’t cut their losses short.” – Victor Sperandeo

The demise of SoftBank?

Softbank has distorted global markets for over a decade, fueling a bubble in unprofitable tech and leading an entire generation of entrepreneurs into believing that the way to success is feeding at the VC trough rather than bootstrapping a company and growing through cash flow.

They absolutely deserve to go bust and their cancerous presence eradicated from the tech landscape.

If you think I'm being harsh, talk to any founder who sat at the opposite end of the table from SoftBank and was given "an offer he can't refuse". Or any founder whose small, profitable business was run over by Vision Fund bros in market share wars.

Softbank going bust is delayed justice.

Hide the Sell button

Why today's selloff isn't turning into Black Monday👇

August 06, 2024

Everyone's favorite AI bubble co CoreWeave has signed a $2 billion deal with bitcoin miner Core Scientific (CORZ).

Wow, a $2 billion hosting deal! That's rich.

Except, it is spread over 12 years, so it works out to $166.7 million a year. And the start date is sometime in 2026.

That doesn't deter CORZ investors from bidding the stock up 11%.

The market has shrugged off the Bank of Japan once again and started to party like it's 1999. Except this time, the smart money is actively hitting the bid and hoping/ praying they can get out in time.

The next down leg is going to be brutal.

Why this sell-off is different

Below is an excerpt from Chuck Butler's The Daily Pfenning (a must read):

"Yesterday was very eerily akin to what is called "Black Monday" , which took place on Rocktober 19th, 1987...

And saw the first time that the Fed, Cabel, Cartel, under Big Al Greenspan, came in to intervene and attempt to save the stock jockey from further losses...

I was glad that the Fed, Cabal, Carel, under Jerome Powell, didn't make the same mistake that Big All did all those years ago...

I remember that day like it happened last month! The Friday preceeding Black Monday, was a ominous sign, in that it sold off a huge chunk...

So, didn't the same things happen this time around? I recall my sister, Barbara, calling me on the phone that weekend, and asking me if she should sell her stocks in her IRA, and I told her " well, are you able to tap your IRA yet? And if you can't, how long until you can? She told me it was quite a few years, so I told her to hang tough that they would be back before she needed to sell them..."

Of course, today is a different story... I doubt I would be alive to see the next stock recovery that recovered all these losses... And the losses that will come when we are really in a recession, and not one that people are just talking about right now..."

The Baby Boomers who are forced to take out their required minimum distribution (RMD) will end up crystallizing losses. Would they rather enjoy their golden years or worry about when the market will come back?

Any decent financial advisor is going to tell them to deallocate to stocks.

Who is left to buy? Certainly not the leveraged players. The world is already all-in on the US stock market bubble. Bond investors have gone back to locking in duration. Retail is irrelevant.

There is no new liquidity coming in.

Don't be lulled into complacency just because others around you are buying the dip. This rally is a gift, a second chance to get out before things get much worse.

August 07, 2024

I wrote about the yen carry trade blowing up on May 2, long before it became mainstream news.

Yesterday, subscribers to the paid newsletter received a macro update on the implications, along with actionable trade ideas.

I also go into why an emergency Fed rate cut between meetings is unlikely.

August 08, 2024

The best argument against having a short book: whenever markets tank, the central banks rev up the money printer and start QE, which makes everything go up.

The best argument for having a short book: while everyone else is panicking and beseeching the Fed to do an emergency rate cut and make money printer go brrr, you're making money on the short side.

There is actually no 'best argument' against having shorts. Shorting just went out of style temporarily and is now coming back, just as value has made a comeback while momentum has gone out of style.

It is all just cycles.

"He can't be drowning. He's sucking up so much oxygen and his head is still above water."

This is how investors are reacting to the market having its Minsky moment. Yes, I know, money printer always goes brrrr. What if it's too late?

In boom times, institutional investors and pension funds trample over one another to secure an allocation at private equity funds. PE firms launch one vehicle after the other to satisfy allocators' demand.

In bust times, PE firms consolidate funds to save overheads. The bubble in business development corporations is over. I wrote about this in my X post on GE.

"Sub-prime mortgages killed GE Capital and brought the whole system tumbling down. I suspect the next credit event won't come out of CRE or the banking system - it'll come from the private debt market and the business development companies that helped fuel the massive Big Tech earnings beats.

This is the risk no one is talking about. But rest assured, it's real. And when it comes crashing down, several of today's storied names will join Enron, WorldCom and Global Crossing in the Hall of Infamy."

August 09, 2024

Luxury goods sector

Luxury goods seller Capri Holdings (CPRI) reported a 13.2% drop in quarterly sales.

"Overall, we were disappointed with our first quarter results as performance continued to be impacted by softening demand globally for fashion luxury goods. We are continuing to manage our operating expenses and inventory levels carefully in light of the challenging global retail environment".

Versace revenue declined 15.4%

Michael Kors revenue declined 14.2%

Jimmy Choo revenue declined 5.5%

Slowing demand for luxury implies the high-end consumer is tapped out. Booming demand at Costco (COST) implies customers are prioritizing savings and bulk purchases of essentials.

At some point, the US stock market will meet reality and acknowledge we're in a recession. Yes, it's different from the GFC in that the banks aren't the ones in trouble this time. There have been no bailouts since Silicon Valley Bank in March 2023, and apart from Intel's 15k, there has been no mass layoffs.

Maybe this will be similar to the Forgotten Depression of 1920-21 than the Great Depression, but all signs point to danger ahead.

The prevailing sentiment is peak complacency even as funds are blowing up. To paraphrase Ayn Rand, reality can be ignored, but the consequences of ignoring reality cannot be ignored.

This was an absolute blast and I talked about:

Gold and the miners

Jump Trading and the crypto market sell-off

Polish banks and carry trades gone bad

Investor complacency regarding the BoJ's policy shift and fund blowups

Recession warning signs

August 10, 2024

Credit where it's due. Jen Huang is smarter than the Lehman traders who plowed their cash bonuses into the stock and went down with the ship.

It's the alternatives era. BX

August 11, 2024

When it comes to trading, there are no sacred cows. I still like Avalanche as a project but no longer own it.

(I also like bitcoin as a project but haven't owned it for months).

Charts don't predict the future but they are instrumental to my trading decisions.

Danaos Corp >> Bitcoin

Over the last 5 years, containership lessor Danaos Corp (DAC) has massively outperformed bitcoin and held those gains. Why are there no Danaos maxis? No $1 million "whether you like it or not" rabid Danaos bulls?

CEO John Coustas owns 47.5% of DAC, which beats MicroStrategy (MSTR) 1% ownership interest in bitcoin and Satoshi's 5% stake. He is more "all-in" than Michael Saylor or Raoul Pal on their favorite coins.

Why are there no Danaos maxis? Because shipping investors understand Modern Portfolio Theory and would never go "all-in" on one stock. Shipping analysts making wild claims would be laughed out of the room, while bitcoin influencers making wild claims get fawned on by fellow cultists.

Crypto cults are dangerous because they promise riches without effort.

August 12, 2024

Osisko Mining Gets Acquired

Gold Fields (GFI) is acquiring Osisko Mining (OSK.TO OBNNF) for C$4.9/share all-cash, upping its ownership in Windfall to 100%. This is an excellent deal for Osisko shareholders, and a win for Gold Fields in the long-term.

Subscribers to my paid newsletter got alerted to my Osisko position on August 6. In my sector update on gold miners, I mentioned Osisko was my no.3 position in the gold mining space, behind a royalty company and a British Columbia based gold explorer.

This is alpha you can't get by just buying an ETF. My newsletter goes from macro-to-micro, picking individual stocks based on fundamentals and technicals while staying on the right side of the macro regime. At $150/month, it is a steal. Just like the first 50% of Windfall.

B2Gold

Looks like I nailed my call on B2Gold (BTG) getting punished for their Sabina acquisition. The recent drop is due to impairments at Fekola but the long-term decline can be attributed to their Sabina acquisition and subsequent cost overruns and delays.

August 13, 2024

Panama Asset Expropriation Update

Orla Mining (OLA.TO ORLA) is seeking $400 million in damages from Panama. Everyone's paying attention to First Quantum (FM.TO) and Franco Nevada's (FNV) case against Panama. If they win, the probability of Orla getting a settlement goes up. At a market cap of $1.15 billion, this is not priced in.

"In March 2024, the Company filed a Notice of Intent to Arbitrate with the Government of Panama under the Canada-Panama Free Trade Agreement (the "FTA"), in respect of the Cerro Quema Project.

The Notice of Intent asserted that certain measures taken by Panama constituted violations of Panama's legal obligations under the FTA and customary international law.

The Notice of Intent was intended to facilitate a 30-day consultation period to reach an amicable resolution to the Company's claim.

As no resolution was reached, the Company proceeded with filing a Request to Arbitrate on July 3, 2024. The arbitration will be facilitated and administered by the International Centre for Settlement of Investment Disputes (ICSID) in Washington, DC, under its Arbitration Rules.

As part of the FTA requirements, the Company submitted an initial and preliminary estimate of damages claimed of no less than US$400 million, plus pre-award and post-award interest.

Although the Company intends to vigorously pursue these legal remedies, the Company's preference is a constructive resolution with the Government of Panama that results in a positive outcome for all stakeholders".

Bitcoin

Peer-to-peer electronic cash. Decentralized crypto currency. Permissionless network.

Trading sardine. Just another CUSIP. Corporate asset.

When the narrative changes, old players are replaced by new players. Bitcoin is witnessing the equivalent of a corporate reorganization.

The old guard of libertarians has been replaced by the new guard of statists and Wall Street. I imagine bitcoin will look very different in a year as this trend continues. MARA Holdings (MARA) can bring back OFAC-compliant mining pools with no resistance. Heck, the new players will probably root for censorship.

If you understand what's happening, you understand why bitcoiners have moved on to Kaspa or privacy coins.

August 14, 2024

“At the end of the day, it is the Panamanian government that has to decide what it wants to do with this asset, and we of course, stand available to be considered as a potential partner sometime in the future,” [Mark] Bristow told Reuters

Talos Energy

Carlos Slim has upped his stake in GoM oil producer Talos Energy (TALO) and now owns 21.3% of the company.

Gold

The Perth Mint sold 25,457 oz of gold and 939,473 oz of silver in minted product form during July, down 42% and up 9% yoy, respectively.

The stealth phase of the precious metals bull market continues.

August 16, 2024

BHP reaches deal with Escondida union in Chile to halt strike.

Friday talk with Jason of AAO Research

On today's show, we covered the gold miners extensively. Is it a bubble? What are the signs we can expect to see at the top? (Spoiler alert: nowhere close to being a bubble). How to pick stocks within this space?

We also touched on copper, natural gas, LNG and the yen.

Nvidia

Nothing to see here folks. Keep buying NVDA for the next earnings pump. Listen to the investors with higher returns than Wall Street's Old Boys Club like Beth Kindig.

“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, one by one.” ― Charles MacKay, Extraordinary Popular Delusions and the Madness of Crowds

August 17, 2024

While everyone's focused on the awesome comeback in tech stocks, gold explorers are rallying in stealth mode.

(Ascot doesn't belong on this list anymore)

FedEx

"I'll FedEx it to you."

Back in 1983, it was called Federal Express (FDX). They had the largest network of couriers and were the undisputed leader in overnight delivery.

The advent of the fax machine caused a demand drop. Offices were mailing fewer documents. FedEx decided to co-opt the new technology and hence, ZapMail was born.

The business idea was: the sender would drop off papers at a nearby FedEx office. FedEx would fax the document to its own office in the destination city, then pass it on to the receiver by courier.

FedEx built an elaborate network of fax machine nodes, thinking it would cut costs by using the new technology.

The price of fax machines continued dropping and soon every office had one. The business became obsolete and was killed 3 years later.

____________________________________________________________________________________________

New technologies - telegraph, radio, fax machine, internet, social media, crypto, gen AI - change the business landscape in ways we cannot imagine. The disruptor gets disrupted and the cycle repeats.

As investors, we cannot control the future. But we can control the price we pay. Chasing story stocks to a high multiple seldom works out.

August 19, 2024

Trump is no Andrew Jackson but it would be good to see him clip Powell's wings a little. Bailing out Silicon Valley Bank depositors while letting less well connected banks fail is discrimination in favor of the wealthy.

Hiking rates rapidly and refusing to provide clarity is causing undue stress to small businesses and preventing them from planning for the future.

Favoring money center banks over regional banks directs credit growth to Wall Street and big corporations at the expense of Middle America, mom and pop businesses, and ordinary folks who would otherwise qualify for a loan.

Austrian school scholar Robert Higgs is right in attributing Regime Uncertainty as the leading cause of the Great Depression.

Powell has caused a recession while simultaneously blowing a giant tech bubble. We will be living with the consequences of this for the rest of this decade.

August 20, 2024

Homebuilders ETFs ITB and XHB say the US housing market is strong. Lumber says the housing market is weak.

Interfor (IFP.TO) announced today that it will indefinitely curtail operations at its sawmills in Meldrim, Georgia and Summerville, South Carolina. These curtailments are in response to persistently weak lumber market conditions.

This sector is impossible to trade on fundamentals alone, but these charts are a trend follower's dream.

August 23, 2024

On October 21, 2021, the Ontario Teachers' Pension Plan invested $95 million in failed crypto exchange FTX.

In April 2023, they declared that they have learnt their lesson and will no longer risk pension money on crypto speculation.

In June 2023, investors panic sold Solana, Cardano, Uniswap, Polygon etc. on the news that Robinhood would de-list them. I was called an idiot for plunging into alts heavily.

We're now back at the stage of the bull market where pension funds feel compelled to "dabble in crypto".

Asset rotations take time to play out, but imo the risk/reward is now unfavorable for putting new capital to work in crypto.

Sure, Sui, Solana, or Kaspa can pump, but I'm better off plunging heavily into gold explorers and being called an idiot once again.

Valaris

Valaris (VAL) Q2 results show the picture isn't much changed from last year.

Jackup revenue excluding reimbursable items is at $167 million. Aramco has followed through and cut capex. ARO revenue is down to $124 million, from $134 million in Q4 2023. UK doubled down on windfall taxes, further driving out investment. The Norwegian part of the North Sea will see declining demand through winter. I suppose the only bright spot is the GoM.

Total contract backlog is $4.3 billion, market cap is $4.4 billion, long-term debt is $1.1 billion.

I've avoided Valaris for a while now because I found it grossly overvalued. The recent price action has piqued my interest.

August 24, 2024

"Apollo Global (APO) and Metropoulos arranged for Hostess to borrow money from the banking giant Credit Suisse. The two firms then pocketed about $900 million of that money for themselves and their investors. Hostess [maker of Twinkies], meanwhile, is stuck repaying the debt".

The private equity firms call it the dividend recap strategy. When they can't find a buyer for the whole business, they torpedo the business by loading it up with debt and getting out as much as they can.

When the firm files for bankruptcy, they buy back the bad credit for cents on the dollar, infuse fresh equity, and repeat the cycle.

The book The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Corruption of the Private Equity Industry offers a great account of how PE works to undermine other parts of the capital structure.

The James Bond in the story is a distressed bond investor who refused to go along (yes, I make bad puns). Unlike a bond villain, they didn't tie him up and try to kill him with a Rube Goldberg machine. He was simply socially ostracised, which in those circles is apparently worse than death.

I read Jared Dillian's article on private equity and for once, agree with everything he says. Volatility laundering (a term coined by Clifford Asness) has caused a massive bubble with real world consequences.

Unfortunately, Fed rate cuts will spur bank lending (a new bank will replace Credit Suisse as the zero due diligence lender), which will spur even more dividend recaps, and load OpCos with even more debt. No surprise Blackstone (BX) is celebrating the alternatives era.

Jackson Hole Powell provided the Hydration IV to cure the industry's hangover from rate hikes. It's time to pop open the bubbly and get gloriously drunk off easy money.

I expected the unwind of the yen carry trade to hit PE hard. Maybe it did, and so they whispered in Powell's ear to do something about it.

If the dollar and yen race each other to the bottom, and US dollar interest rates are cut to zero, the old carry currency can simply be replaced with the new carry currency, Level 3 assets can continue to be marked-to-myth, and the distributions can keep flowing.

Private equity + Credit Suisse and partners is a perversion of capitalism.

August 27, 2024

"Already the U.S. is being ruled by those who accept bribes from foreign powers. Whatever our opinions about Russia and Putin, he is a keen observer of international affairs: buying gold “is the right thing to do.” - Myrmikan Capital

August 28, 2024

There are 4000 stocks listed on US exchanges, and a dozen popular brokerage firms.

Now imagine a new broker opened shop and marketed itself as superior to Fidelity because they only allow Apple shares. That's how dumb it is for a crypto company to be bitcoin-only.

My old marketing professor used to joke that there's a gap in the market for a lukewarm salted coffee, but there is no market in that gap. Relai reminds me of that joke.

Bitcoin is going obsolete

BlackBerry Messenger (BBM) was once an extremely popular messaging software. In fact, owning a BlackBerry device and using BBM to send IMs was considered a status symbol.

When the smartphone user base expanded after the introduction of the first iPhone, BBM became less relevant because it wasn't cross-platform. BlackBerry fixed the problem in 2013, but by then WhatsApp had taken the lead and the rest is history.

BlackBerry, the company, still exists, but is irrelevant today in the smartphone space.

____________________________________________________________________________________________

Bitcoin was once an extremely popular crypto-currency. In fact, using the bitcoin network to send sats across the internet was considered cool and cypherpunk.

When the cryptocurrency user base expanded after the launch of ethereum, bitcoin became less relevant. The bitcoin network wasn't cross-platform. You could only use it to transact in bitcoins. Whereas, you could send virtually anything as an ERC-20 token on ethereum.

In 2019, bitcoin developers addressed the problem by introducing wrapped bitcoin, facilitating bitcoin use on the ethereum network. But it was too little too late, and other cryptocurrencies took the lead.

Bitcoin, the 6th oldest cryptocurrency, still exists, but is less relevant in the overall crypto space.

Just like the BBM users, the bitcoiners have been slow to adapt to change and still think being "bitcoin-only" is a status symbol.

In a decade, business schools will teach case studies on bitcoin, drawing historic parallels to other innovations which succumbed to change.

Fraud Alert: Super Micro Computer Delays 10-K Filing

Super Micro (SMCI) delays filing its annual report, which is code for they couldn't get their auditors to sign off on a blatant accounting fraud.

You could have seen this coming a year ago, but then you'd have missed the stock manipulation on the way up and the wild ride on the way down.

The Swiss National Bank printed money to buy into SMCI. Sell-side analysts touted the shares with a $1350 price target so investment bankers could make their fees on the bond offering. Momentum chasers sent the RSI to 100 - a record breaking event.

But all manipulations eventually end in ruin, and Super Micro is no different. NVDA is next.

The investment bankers got their fees. The SMCI ratings downgrades can now proceed. Even the sell-side analysts who would sell their integrity for a dollar don't want to be caught with a Strong Buy rating on an accounting fraud.

Good Trading!

Kashyap Sriram

Comments