Monthly rollup | February 2025

- Mar 1, 2025

- 13 min read

Stocks Mentioned Total (TTE), Venture Global (VG), Cheniere Energy (LNG), Tellurian (TELL), MicroStrategy (MSTR), Microsoft (MSFT), Tesla (TSLA), Super Micro Computer (SMCI), Nvidia (NVDA), Patterson-UTI Energy (PTEN), Allied Gold (AAUC.TO; AAUCF), Golden Ocean (GOGL)

Highlights

February 02, 2025

Japan considers backing a $44 billion, 800-mile Alaska gas pipeline, which is part of Trump's plan to unleash Alaska's resource potential.

Meanwhile, the land of fish and chips just ruled against Shell and Equinor's projects in the North Sea, citing Scope 3 emissions risk.

Two generations ago, the British navy made the strategic shift from steam to diesel engines, a move that cemented their maritime advantage and won them the war. Now, they're worried about North Sea oil making it easy for John Doe to fill up his gas tank.

While Trump is using tariffs as a club to bully his allies, the greenies are using UK courts as a wrecking ball for their own economy.

Both approaches are terrible for the long-term, but at least one of these is an investable trend.

Trinidad and Tobago has a thriving refining industry as a direct consequence of the Jones Act.

The tariff war, while detrimental to everyone living in North America, is bullish for container freight and maybe dry bulk. Trading firms will just add a hop, do a transshipment to a neutral country, and be better off than paying the 25% tariff.

The Baby Boomers were told "Never sell your IBM shares".

In my native language (Tamil), we have a saying:

மண்ணுல போடுற காசும் பொன்னுல போடுற காசும் எப்போவும் வீணாகாது!

It means "you can never lose wealth by buying land and gold".

In general, Indians feel wealthy when stocks appreciate in price, but lament when it becomes expensive to buy more land and gold.

Because land and gold are bought with the intention of passing it down through the generations.

Creating a legacy requires owning hard assets forever. Food for thought.

February 04, 2025

Don't be a turkey

The turkey feels safest two days before Thanksgiving.

By then, the nice human has fed it well for 5 straight months. The turkey studied linear extrapolation in statistics 101 and can draw a regression line as good as any chicken or high school AP student.

But, the turkey never understood what drives the farmer. That missing knowledge would prove fatal.

Every time I look at a statistic, I ask myself: what is this not telling me, that I should know before using it for decision making?

To elaborate, statistical studies are only commissioned because someone is willing to spend time and money testing a hypothesis. If the results of the study do not reinforce the original view, they are not published.

That's the first layer of bias - you only see the results that make it to market.

The second layer of bias is in the data that gets picked up and reported on. To become popular, the data has to feed the consensus view. Contrarians don't get invited to CNBC, nor do they write sell-side research reports (Albert Edwards is the exception that proves the rule - bet FinTwit never heard of him!).

And lastly, there's confirmation bias. Traders tend to look for data that supports their decision, and ignore ones that don't. The study that makes you feel safe in your decision is more dangerous than lack of data. Uncertainty is your friend.

Even if you correct for these three biases, you're competing against the best quants in the world if you're seeking a statistical edge. If there's actionable intel, they'll beat you to it and arbitrage it away. If not, it's useless or dangerous.

This is why I'm not a fan of backtesting or statistical analysis. That field is best left to the quants who grew up on SPSS and R.

February 05, 2025

Active vs Passive

The Wharton school told us to hold stocks for the long run.

The Vanguard group told us that passive investing beats using your brain.

The pension fund consultants told the hedge funds they will be benchmarked against the S&P 500. The entire active investing world, which had resisted the Jeremy Siegel and Vanguard marketing onslaught, succumbed to the benchmarking virus.

Gradually, the investment universe shrunk from the Wilshire 5000 to the S&P 500 to the Magnificent 7.

When we look back on this a decade from now and ask, "what were investors thinking?", the answer will be: no one is thinking.

iShares and Vanguard are doing what's best for AUM growth and fee collection. Robinhood is luring retail investors into a digital Sin City.

This is what a mania feels like. China went through this experience in 2014. A decade later, investors still don't want to touch Chinese equities, even though they offer tremendous value.

A similar fate awaits the Mag 7. And active investing is going to run circles around the index hugging crowd.

February 06, 2025

Venture Global

Total (TTE) CEO says company rejected Venture Global (VG) as LNG supplier over lack of trust.

Venture Global was supposed to IPO at $40-$46. Actual IPO price: $25.

Current market price: $17.5.

Someone page CoreWeave. The dumb money is chasing memecoins, not SPACs or IPOs. This isn't 2021.

February 07, 2025

Reading the Venture Global (VG) prospectus, three things stand out in the first few pages:

The company uses pre-fabricated material shipped in from Italy and follows a modular approach to building LNG trains, which they say is cheaper, faster, and superior to on-site construction using contractors like Bechtel.

The company started producing LNG at its Calcasieu plant in March 2022 but still hasn't completed construction and announced commercial production.

A likely explanation is they don't want to declare commercial production and start fulfilling their long-term contracts. Which explains the Total CEO's comments.

It gets worse. Company insiders control 97.9% of voting power through their ownership of Class B common stock. Mark Zuckerberg controls just over 50% through his supervoting shares at Meta. The Venture Global guys have one-upped Silicon Valley in entrenching themselves.

Shareholders at Cheniere Energy (LNG) and Tellurian (TELL) could at least fire Charif Souki. VG shareholders are screwed.

The stock is a terrible investment at any price, even if the numbers look good. Value investing cannot fix corporate governance issues.

Holy smokes. I can't stop reading the prospectus. MicroStrategy (MSTR) can learn a thing or two about shareholder dilution from VG.

February 10, 2025

Gold

In 1907, the Knickerbocker Trust Company attempted to corner the market in United Copper. Their failure led to the Panic of 1907 - a banking crisis that resulted in gold hoarding.

In 1979, the Hunt Brothers attempted to corner the market in silver. Their failure killed the decade-long commodity bull market.

In 2025, MicroStrategy (MSTR) attempted to corner the market in bitcoin. Their failure killed the crypto bull market and revealed that bitcoin was just digital pyrite.

Meanwhile, the vaults at the Bank of England, LBMA and Comex are emptying out as investors clamor for gold. Saylor, Larry Fink, etc. are distractions. The bitcoin media are useful idiots distracting the populace while smart money empties out available bullion.

Gold is up 43% in the past year and rising fast because we're about to enter a crisis. Yet, NOBODY CARES because digital pyrite is in 'da newz' while gold isn't.

Welcome to the golden age of grift. It does not end well for the grifters and their flock.

February 11, 2025

Horizontal line represents MSTR Q4 average purchase price. Can they continue to levitate bitcoin or is the Ponzi running out of greater fools?

MSTR is to Bitcoin as FTX was to Solana. Except, Solana has an actual use case and managed to bounce back. Bitcoin, with its 7 tps limitation and high fees, is likely done after this cycle.

Hyperscalers can learn from Dell's missteps

In the Microsoft (MSFT) earnings call, the CEO draws a parallel between client server to cloud migration and cheap AI inference.

True - cloud usage shot up. Also true - Dell and IBM lost out.

Every move in tech creates winners and losers. The loser due to falling cost of inference is Microsoft and other hyperscalers. Their massive capex spend isn't getting its payday precisely because you can now run DeepSeek on your PC.

Cloud migration saw Dell servers plummet in value. The company itself was taken private by the founder and a PE firm.

Microsoft doesn't get to gloss over the huge hit it'll take on its capex outlay. The hyperscalers are the victim of cheap inference, just as Dell was a victim of client server to cloud migration.

February 12, 2025

From "There Is No Alternative" to "Mag 7 is vulnerable", the past year has been anything but normal for equity investors.

If Cantor had made this statement last year, they would have lost credibility. Now, it is consensus. This is how narratives shift.

There's already a sector rotation underway, so it feels "safe" to say underweight the Mag 7, especially with Tesla (TSLA) taking an 18% dive this year.

There's a saying that bull markets don't die of old age. Maybe this one can keep going, with commodity driven sectors rising to make up for the fall in Big Tech, but I doubt it.

There are only about 30-40 companies in the $200B-$1T market cap range. The B-team just cannot rise fast enough to offset the rotation out of the Mag 7.

Bitcoin mining

The mining centralization problem in bitcoin is actually far worse than I feared. According to Block Pro Research, the top 3 mining pools account for 65.75% of hash power.

Foundry - 29.5%

Antpool - 22.95%

ViaBTC - 13.3%

"Daily mining revenue per TeraHash per second (TH/s) produced by the Bitcoin network suggests that miners are earning roughly $0.046 per day for each TH/s they contribute to the Bitcoin network. This is down 50.98% from roughly $0.095 at the beginning of the year".

With block rewards falling fast thanks to the flawed halving model employed by the BTC protocol, the miners are more incentivized than ever to change the code. Even more so as total hash rate and mining difficulty continue to climb rapidly, adding to their woes.

Bitcoin today reminds me of EOS in 2018.

28% of all crypto inflows last year were MSTR alone. 25% of total 2017-18 ICO raises were EOS alone.

The EOS project - which promised to be an ETH killer - ultimately became controlled by a few Chinese whales and disappeared.

A similar fate awaits bitcoin. IMO, bitcoin in its current form should never have been allowed to retain the original title. Bitcoin Cash would have had a shot at fixing the protocol if the other fork was called Bitcoin Core instead of just bitcoin.

Ironically, BTC Core didn't want to increase the block size because developers said making bitcoin usable would create miner centralization. Here we are, and the problem is far worse than I imagined. With no easy fix since there is no leadership.

Bitcoin is doomed.

Yields

2 year treasuries are at a make-or-break level.

What happens if Scott Bessent succeeds at yield curve control on the 10Y but the 2Y yield moves above Fed Funds and the commercial paper market blows up? Will the Fed restart QE, inflation be damned? Will banks borrow short and lend long, learning nothing from the collapse of SIVB and First Republic?

The old Chinese curse - may you live in interesting times - certainly applies to bond investors this year.

February 13, 2025

Due to a much colder winter, gas consumption across Europe is expected to increase 17% this month from a year ago, with EU gas inventories rapidly depleting and now only 48% full.

February 17, 2025

The EU emissions trading system is like the Jones Act on steroids.

Trade within the EU carries a 100% penalty. Trade between an EU port and a non-EU port carries a 50% penalty. Avoiding the EU altogether carries a 0% penalty.

The whole point of creating the Eurozone was to dismantle trade barriers and promote greater intra-Europe trade.

It's like the Brussels bureaurats spend all their time at Davos sipping champagne and coming up with new ways to destroy Europe.

February 18, 2025

Venture Global

Venture Global VG finally declared commercial production at its Calcasieu Pass LNG project. Production began in Jan 2022. That's 3 years to ramp up to CP.

Russia's 0.6 mtpa Vysotsk LNG, which launched operations in April 2019, produced its first million tonnes of LNG by Jan 2021 and 3 million tonnes by September 2023, despite sanctions, harsh winters, and the loss of EU market share.

If Russia becomes investable again...

We are NOWHERE close to even the beginning of gold fever

Super Micro Computer Fraud

The Nasdaq gave Taiwanese company and two-time accounting fraud Super Micro Computer (SMCI) a waiver, allowing it to remain listed on the exchange well past the deadline for filing its audited financial statements for the year ended June 30, 2024.

Their external auditor EY (who replaced Deloitte) resigned and gave such a qualified opinion of SMCI's press release (appended below) that they left no room for doubt.

In response, the company hired a new Director, who formed a Special Committee of the BoD consisting of just her. In the company's own words:

"The Special Committee is comprised of Susie Giordano, an independent member of Supermicro’s Board of Directors. Mrs. Giordano, an experienced attorney, joined the Board in August 2024 specifically to lead the Special Committee’s efforts..." - SMCI SEC filing from Dec 2, 2024.

After stating on November 5th that the Special Committee (i.e. Susie Giordano) had found no evidence of fraud or misconduct, on Dec 2nd Mrs. Giordano recommended firing the company's CFO and Chief Accounting Officer.

Although Mrs. Giordano claimed to have found no evidence the company violated US export controls, a concern that was noted by EY prior to resigning the account, she recommended the company hire a Chief Compliance Officer, appoint a General Counsel, and expand the company's legal department.

The company's external auditor BDO USA who replaced EY in November 2024 has not provided any reassurance or update on the audit.

Typically at this stage, the stock would be de-listed and the company's creditors would force it into bankruptcy. Instead, the company just raised $700 million in convertible debt and is privately negotiating with creditors while the common stock continues to trade.

On Feb 3rd, the company put out a press release announcing that it will provide a second quarter fiscal 2025 business update on February 11. The stock rallied from $26.85 to as high as $42.88 on higher than average volume going into the announcement.

On February 10, the following insiders took advantage of the share price rally to dispose of shares in the market, a day ahead of what investors construed to be a material news event.

President and CEO Charles Liang

Director Chiu-Chu Sara Liu Liang

SVP, Chief Accounting Officer Kenneth Cheung

SVP & CFO David E Weigang

SVP, Worldwide Sales Don W Clegg

SVP, Operations George Kao

Liaw Family Trust, related to Director Liaw

Industry sources say SMCI is Nvidia (NVDA's) third largest customer. Nvidia has neither confirmed nor denied the relationship.

SMCI is currently under investigation by the DoJ and SEC.

In light of overwhelming evidence that keeping this stock listed is not in the public interest, the Nasdaq stock exchange has taken no action.

February 20, 2025

"Japan's Norinchukin Bank reported wider losses this month as it boosted investments in riskier leveraged loans and sought additional capital. Its losses of ¥1.4 trillion ($9.2 billion) in the first nine months of its fiscal year ending in March were close to the ¥1.5 trillion annual loss it had previously projected. The bank also reported ¥1.57 trillion in paper losses on its bond holdings".

When you know you will get a bailout, the smart thing to do is trash the remaining equity and get to insolvency sooner. Bear Sterns, Countrywide, Washington Mutual got a bailout. Lehman was sent to the cleaners. Of course, that playbook didn't work in 2023. Silicon Valley Bank and First Republic got a bailout, Silvergate and Signature got shut down.

Now, is the yen strengthening because Japan is about to have a deflationary banking crisis? Or is it strengthening because the BoJ will be forced to hike rates amidst a banking crisis, like the Fed did in March 2023?

Japan's banks are lending money at 1% so borrowers can speculate on bitcoin. Their standards are worse than Icelandic banks in the 2000s. If the yen continues to strengthen, it's bankruptcy time.

US driller Patterson-UTI Energy (PTEN):

"On the natural gas side, we see a positive outlook over the next several years with a clear need for more natural gas directed drilling and completion activity to satisfy growing natural gas demand. We could potentially start to see natural gas activity come back late this year and definitely into 2026."

Henry Hub prices have increased 150% in the past year. IRA incentives and Trump tariffs will bring more manufacturing to the US. The lifting of the Biden era export ban is a long-term tailwind for LNG.

The relationship between oil majors cutting capex spend in the Permian and the revenue outlook for onshore drillers isn't straightforward.

February 21, 2025

Warren Buffet risked 40% of his fund in American Express when that company was technically insolvent. The bet paid off. Had it not paid off, you wouldn't even know his name.

What makes Buffet smarter than most gamblers is he knew not to play Russian Roulette a second time.

February 25, 2025

Allied Gold

Allied Gold (AAUC.TO; AAUCF) just announced a transformative Mali deal and concurrent private placement. First, the good news for Allied shareholders.

Allied has lowered its Mali risk by selling 50% of its Sadiola equity interest for US$145 million in cash, plus deferred cash consideration the company estimates is worth US$230 million.

This immediately cashes up the company and allows it to focus on building the Kurmuk mine in Ethiopia. Given Mali's success in extorting Resolute, B2Gold and Barrick, this is a big de-risking event for Allied shareholders.

The bad news? The company is diluting shareholders by 12% at C$3.4/sh, a 25% discount to yesterday's close. The funds raised - approx. US$110 million - will be plowed right back into Mali.

But, the dynamics change. Its backer is a fund in the UAE, and UAE and Africa have good relations. Allied will no longer be seen as Western/ Canadian and should (in theory) be immune to extortion.

The $110 mn it brings into the country will be seen as "fresh capital", a "show of confidence" in the new Mali mining code and political regime.

It is a brilliant piece of deal making, financial engineering, and good local PR.

I've done due diligence on Allied on behalf of a family office client and met Peter Marrone to discuss Mali risk when they were making an example out of Terry Holohan.

The gold mining space is full of deals like Equinox-Calibre. Nobody cares because management often doesn't have skin in the game and gets rich off stock options. Allied... might be different.

"What did you get done this week?"

"I raised my price target on NVDA and recommended Buy."

"Good. The company reports earnings tomorrow and every little bit helps."

It's the easiest job in the world until the bubble bursts and your name becomes as (in)famous as Henry Blodget.

February 26, 2025

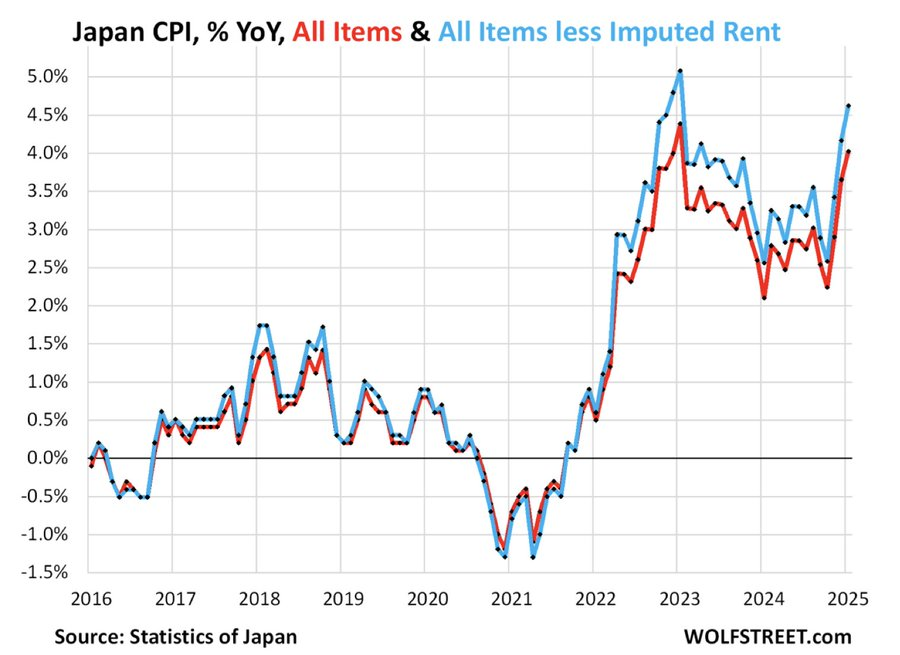

Food Inflation soars in Japan

The Japanese government has been deliberately trying to create inflation for a decade, 'cos nothing benefits old people more than higher cost of living.

Well, they got their wish.

Now will they reverse course and end the carry trade, or send vegetable prices (up 25.6% yoy) into the stratosphere?

In India, the soaring price of onions once determined an election. In Tunisia, un-affordability of food led to the overthrow of the government. Same case with Sri Lanka. And these are just examples off the top of my head.

The BoJ can either let inflation run and blow a bigger debt bubble, or let the bubble collapse and go back to a deflationary '90s like scenario.

There are no good choices.

February 28, 2025

Quality dry bulk shipping co. Golden Ocean (GOGL) saw a massive volume spike around earnings. The on-balance volume confirms the band squeeze breakout. Stock is at 8.8x 2024 earnings.

Dry bulk will have a terrible Q1 to add on to a terrible 2024. Is the market forward looking?

Like what you read? Get more exclusive content by subscribing to my premium newsletter!

Good Trading!

Kashyap

Comments