Monthly rollup | January 2025

- Feb 1, 2025

- 16 min read

Updated: Jun 1, 2025

Stocks Mentioned SonicShares Global Shipping ETF (BOAT), Bitcoin Miners ETF (WGMI), New Fortress Energy (NFE), Nvidia (NVDA), Schwab (SCHW), Tesla (TSLA), Amazon (AMZN), Plantir (PLTR), MicroStrategy (MSTR), AT&T (T), Okeanis (OET.OL, ECO), DHT Holdings (DHT), Twilio (TWLO), Coinbase (COIN), Silicon Valley Bank (SIVB), GameStop (GME)

Highlights

January 02, 2025

The best performing sector last week was SonicShares Global Shipping ETF (BOAT), up 4.8%.

The worst performing sector last week was the Bitcoin Miners ETF (WGMI), down 5%.

Read into it what you will, but I personally own a lot of shipping stocks and zero bitcoin mining stocks.

New Fortress Energy

Puerto Rico suffering blackouts. If only they had paid their power bill instead of trying to nationalise New Fortress Energy (NFE)'s assets.

January 04, 2025

As if Nigeria weren't already un-investable. Did they import some busybodies from Brussels or is this 100% homegrown madness?

Palm Oil

Palm oil went up 20% in 2024 on this news and is already causing rising food inflation in the poorer parts of the world.

I can never understand the greenies obsession with putting food into the fuel tank. India is the same with the sugarcane crop.

Jim Rogers once remarked that if all the sugar producers in the US were given $1 million and a Ferrari in exchange for lifting tariffs on sugar imports, the US as a whole would be better off. If all these nonsensical blending mandates were ended, the world as a whole will be better off.

It was fossil fuels, not Greenpeace, that killed the Japanese whaling industry.

US Steel

DP World all over again.

Gotta love it when an American CEO lambasts Biden by saying "The Chinese Communist Party leaders in Beijing are dancing in the streets. And Biden did it all while refusing to even meet with us to learn the facts."

Spotting fraud: an Anecdote

Alcohol: because the best stories don't start with "I was eating a salad".

It was at a party with finance folks and a senior Chartered Accountant (Indian equivalent of CPA/auditor) was talking about one of his first assignments on behalf of a private lender.

His client was extending a loan to a manufacturer and wanted to conduct due diligence on plant operations. The CA's job was to spend a couple of weeks hanging about nearby and make a log of all trucks entering and exiting the factory.

When they began formal due diligence, the audit team's log was compared to the company log at the security gate to find discrepancies.

That single act was sufficient to walk away from the deal.

SMEs in India tend to have two sets of books - one for the revenue department and income tax, one for the owner and investors. This business had a third - for lenders - which overstated actual activity, physical inventory, and sales.

There was only one way of catching it, and that was by conducting boots on the ground due diligence day in and day out.

These days, external auditors simply rubber stamp company accounts, take their payday, and think nothing of professional standards. The old days were better (every drunk Indian uncle story has this line).

As a rookie equity analyst and then mining stock analyst, I never dreamt I'd one day spot accounting fraud at a graphics card maker, whose products were lovingly owned throughout childhood, when I spent endless hours playing video games on my PC. Yet, here we are.

Life happens. Someday, when I am old enough, I'll be the drunk uncle regaling a cocktail party with my Nvidia (NVDA) story.

January 05, 2025

January 06, 2025

The Nvidia halo

We're at that point in The Halo Effect where NVDA puff pieces lauding their culture and "intellectually honest way" are now being given airtime. Wonder why that honesty doesn't translate into their accounting.

Gives me Cisco 2000 vibes.

On Trading

Trading is a journey. There are good years, bad years, and great years. 2022 was a tough year both for me and my clients because I was long-only equities and was just starting to learn futures trading.

Since I wrote this, it took another 3 months before things got better, and another year or so before I became consistently profitable in futures.

Was it all worth it? Closing the books on 2024, I can say with the benefit of hindsight - YES!

January 07, 2025

Zigging while others Zag

Schwab (SCHW) clients increased their exposure to equities in December, with the most popular buys being Nvidia (NVDA), Tesla (TSLA), Amazon (AMZN), Plantir (PLTR) and MicroStrategy (MSTR). Investor sentiment remains bullish.

My favorite buys in December were dry bulk, tankers, gold explorers, copper and gold miners.

Sanctions ignite tanker rally

This explains today's big rally in tanker stocks.

January 09, 2025

Following the end of World War I in 1918, the French franc lost 80% of its value in less than 6 years.

Everyone knows the story of Weimar hyperinflation, but France, portrayed as one of the good guys in this fight because winners write the history books, suffered nearly as much.

Americans looked down on the French so much that tourists would light their cigars with franc notes to irk them.

Even if Trump is successful in annexing European land and Canada, I expect the dollar to weaken. Winning a fight doesn't necessarily translate into a stronger currency.

Staying long gold is a no-brainer trade. Pet rocks over tech stocks.

The new roulette wheel: Leverage single share ETFs

Casino stocks are hurting because Wall Street has the retail gamblers in its thrall. A 2x long NVDA ETF commands $5.37 billion in assets.

Once this bubble bursts and "investors" lose 80%, the SEC will wake up and starting banning such products.

SOX was implemented after the big accounting scandals of the dotcom era.

Glass-Steagall and deposit insurance came into effect after the banks went bust in the Great Depression.

This time will be no different.

January 10, 2025

Gold

Gold was up 27.5% in 2024, making one record high after another, and still no one cares. This bull market is in its early stages.

Post the dot com bust, gold went up every single year until 2006. While I'm not buying physical gold for the gains, I am buying mining stocks for their alpha to gold.

Interest rate divergence

Since September 2024, while the Fed cut rates by 1%, the 10-year yield moved higher by 1.2% - a 2.2% divergence. The 2-year yield, which should more closely track Fed funds, has risen 90 bps - a 1.9% divergence.

Gold and oil are signaling rising inflation, and the timing couldn't be worse for the Fed.

This is how Minsky moments occur.

The Fed can always just print money and do yield curve control, so caution is warranted. There are no obvious winners here, except for volatility products.

January 13, 2025

Stocks for the long run. In the long run, we're all dead and our estates taxed unto nothingness.

"Index fund enthusiasts set themselves too easy, too useless a task, if in tempestuous seasons they can only tell us, that when the storm is long past, the ocean is flat again." - John Maynard Keynes on the Bogleheads

Tariffs are inflationary

The Fed prints money and causes inflation.

DJT imposes tariffs and pours gasoline on the inflation fire.

But sure, buy the dollar 'cos milkshake guy says so.

At the end of the 1970s stagflation era, Jimmy Carter (RIP) had to issue bonds denominated in Swiss francs because international investors did not want their debt to be devalued by Fed money printing.

Lowering imports through tariffs, in theory, means less dollars flowing out of the US, which is dollar bullish. In practice, it means trade flows adapt and the global demand for dollars diminish, which is structurally bearish the dollar.

If dollars don't flow out due to trade, they don't get recycled back into US capital assets. That kills liquidity for the Mag 7 and US treasuries, hence the panic in the market.

Maybe the intent is to weaken the dollar to promote US manufacturing. If so, rising bond yields are here to stay and the US stock market (~70% of the ACWI) is headed for a deflationary crash, Japanese style. 60/40 will get killed in this scenario.

No one is prepared for this because everyone assumes the US has learnt its lessons from the Smoot-Hawley disaster. But perhaps not.

2025 is going to be a great year for macro.

January 14, 2025

In 2008, a bunch of very rich people made a lot of money betting against home owners. The catch? AIG FP was on the other side of the trade and did not have the cash to make the payout.

The US government rode to the rescue, "bailing out" AIG so it could make whole on the CDS bets.

In 2023, a bunch of very rich people had too much money on deposit at Silly-con Valley Bank and didn't bother to pay a premium for deposit insurance above the FDIC limit.

The Treasury, FDIC and Fed rode to the rescue with a Sunday evening bailout so no one would even suffer an inconvenience, let alone actually take a haircut on their deposits.

In 2025, a bunch of very rich people in LA had their homes burn down.

What will the Fed and US government do in response?

The answer to this is not "they will print money". That's a given. Question is, when will they print, and what form will the printing take? Ergo, where will the liquidity flow to?

January 18, 2025

Imagine there's a stock that goes up every single year. You make a living selling naked puts and pocketing the premium, compounding gains year after year.

One day the company announces it is a fraud and the stock tanks 80%. You blow up.

You can be right 90% of the time and still lose it all by being wrong just once.

The math of drawdowns and recovery is brutal. Bitcoin has everyone's attention because it has been an outlier, and hence has gotten a lot of media coverage. But you only need to be wrong once to lose a decade's worth of accumulated gains.

Terra Luna took a mere 5 days to hit zero. Luckin Coffee tanked overnight. Apple fell 80% in a day when the dotcom bubble burst.

I enjoy watching memecoin speculation just like anyone else in crypto, but I'd never risk serious capital on memes no matter how popular or time tested they are.

January 19, 2025

Trump and Melania memecoins - The grift heard around the world

You work for an asset allocator at Zurich, London, Dubai, HK or Tokyo.

You wake up on Saturday and find out the incoming President of the United States has hosted a crypto ball and launched a memecoin that's notionally worth several billion dollars on 20% float. The prevailing sentiment seems like a scene right out of The Great Gatsby (1925).

You call a meeting on Monday morning and this is top of the agenda.

Do you:

Allocate more to crypto because the POTUS is friendly to that industry?

Lower US exposure because this is the mark of an un-serious leader?

In the backdrop of tariff threats, invasion threats (Panama, Greenland), denigration of allies (51st state), a recurring debt ceiling crisis, soaring bond yields, and a massive bubble in US equities, the allocators are going to see a leader more bent on enriching himself than actually doing something good for the country.

America is now a Sell.

Trump 2025 = Hoover 1929. The difference: The Great Stagflation rather than a Great Depression this time, since Powell stands ready to print trillions on demand.

January 21, 2025

The state of New York: "From each according to his ability, to each according to his needs."

AT&T (T): "Communism doesn't work. I'm outta here."

January 22, 2025

A good analyst always looks at the data, and before forming opinions, asks - what is missing in this data?

Statisticians are trained to spot survivorship bias.

However, social media amplifies survivorship bias since the losers don't publicise their losses. And onlookers, who see only one side of the story, feel the FOMO and inevitably end up on the losing side. This is why bubbles are dangerous.

January 23, 2025

Okeanis eco tankers

Okeanis (OET.OL, ECO) is my no.2 position, behind only New Fortress Energy (NFE).

The buzz is that the tanker story is done now that a ceasefire deal has been announced and the Houthis have [mostly] opened up the Red Sea. But if you go back to October 2023, the fundamentals were already bullish for tankers. US ramping up sanctions is even more bullish.

A tailwind has gone missing, but the fundamentals haven't turned bearish.

In any other year, I'd have sold and rotated into something with more momentum, but I'm enjoying my experiment with longer holding periods and less churn.

Also, DHT Holdings (DHT) has bucked the correction in tankers. VLCC rates continue to skyrocket. I think tankers will rally and surprise everyone waiting for a bigger dip.

January 24, 2025

100% gain on Twilio

The death of value investing is greatly exaggerated.

When I bought Twilio (TWLO), the stock was valued at 2.3x sales.

Twilio and Sinch are a duopoly in the SMS based authentication space. It was one of those rare tech stocks that traded below book value. Investors hated it because SMS based authentication is a dying business. SIM swaps are so common, Coinbase (COIN) is facing several lawsuits for being such an easy target.

The stock got hammered when the 2021 tech bubble burst and never recovered.

How did I know when to buy in? The weekly chart offers a clue.

On-balance volume bottomed and made higher lows when the stock made higher lows. There was a Bollinger band squeeze (daily chart not shown here), which triggered my Buy alert. The lower trendline gave me a stop loss point. The stop was so close, there was minimal risk to this trade.

Never mind that the stock had been dead money for a year. The setup was as close to perfect as it gets. A value stock with a momentum tailwind, with no bullish news or other factors to explain the move.

In less than 4 months, the stock has doubled, and I bought it after it was already up 24% from its lows.

Timing the market matters more than time in market.

Value investing is misunderstood

Charts like this are irrelevant to me because I trade individual stocks, not a factor or an index cooked up by an asset gatherer.

These days, everyone just wants to "allocate" and hand over the stock picking to a 25yo analyst at an ETF provider where all buys and sells are at VWAP and rebalancing is automated.

In that world, it makes sense that everyone just wants growth and momentum. It's not like there's a real skilled analyst sitting behind the desk picking stocks.

If you lump 30 value stocks together, chances are your returns will be middling. If you lump 30 growth stocks together, even if 5 of them go to zero your returns are still going to be superior to the value basket.

Ben Graham popularised the concept of buying net-net stocks, i.e. stocks of companies trading below cash value. That's not value investing. That's buying dogs with fleas that have been abandoned because there are serious red flags at the company.

Another concept that gets thrown around is comparing value stocks with cigarette butts lying on the gutter which are still good for one last puff. No self-respecting person would touch the latter, and no serious value investor would buy the former.

Correctly defining value and actually picking individual stocks works just fine as an investment approach.

Trump vs Powell: The battle royale begins

The Fed has so little credibility this statement by Trump is actually true.

They printed $3 trillion in 40 days and took rates to zero to fight the 'flu. Then they claimed the resulting inflation was transitory.

After lamenting in 2019 that all their money printing had resulted in very little inflation, in 2022 they did an about turn and embarked on the fastest rate hike campaign in the Fed's 110-year history.

Then Silicon Valley Bank (SIVB) fails, and a year's worth of QT is undone in two weeks.

After resisting rate cuts while inflation turned lower and unemployment rose, they cut 50 bps as part of their Biden re-election mandate. Now that Trump is in office, the Fed suddenly cares about inflation and wants to hold rates steady or even hike.

High interest rates are hurting industrial activity and increasing govt borrowing costs while doing nothing to discourage speculation. People are exchanging their dollars for memecoins!

Thanks to the constant meddling and mixed signals from Powell, Fed Funds rate as a policy tool is broken.

Jerome Powell should be fired and replaced with a rulebook. The ability to print trillions digitally is too powerful a weapon to be entrusted to any human being.

"Permit me to issue and control the money of a nation, and I care not who makes its laws!" - Rothschild

Bank of Japan

One of the below four statements is accurate:

"The rise in underlying inflation is moderate. I don't think we are seriously behind the curve in dealing with inflation." - Kazuo Ueda, Bank of Japan, January 2025.

"I really doubt we're going to see an inflationary cycle." - Janet Yellen, May 2021.

"The subprime mess is grave but largely contained." - Ben Bernanke, May 2007.

"When it becomes serious, you have to lie." - Jean-Claude Juncker, European Commission.

January 25, 2025

Canada supplies more oil to the United States than every other foreign nation - combined. They should send a message to Trump by temporarily banning exports to the US, righting the 51st state insult. Expand TMX, build some refineries, and bring back jobs as well as economic growth.

I expect great things from the country if they elect Pierre Poilievre.

January 26, 2025

The 1990s was a terrible decade for the Japanese. You wouldn't know it if you pulled up charts of US equities. It was a tale of two different worlds.

The last decade has been terrible for Chinese equities. And once again, it didn't matter for US equities. It was a tale of two different worlds.

When US equities enter their own lost decade, international equities will be just fine.

That's my answer to the question of why own stocks if you think the S&P will go down.

January 27, 2025

Minsky moment is closer than it appears

"Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, one by one." - Charles MacKay

Has DeepSeek AI started the process of AI investors recovering their senses?

Will OpenAI be the Motorola Iridium of this AGI era? If so, what are the implications for the stock market?

R.I.P American exceptionalism

January 28, 2025

If Credit Suisse were an American bank, Archegos would have gotten a bailout just like LTCM.

The AI bubble is more dangerous than dotcom. It is so much bigger that the bubble popping would be dangerous for faith in Trump's presidency.

Unlike the rapid collapse during dotcom, I expect this one to be drawn out.

During the Bush presidency in 2008, the SEC banned short selling to halt the decline in the market.

Robinhood removed the Buy button during the GameStop (GME) mania. They can simply remove the Sell button this time.

The Bank of Japan started buying Japanese stock ETFs in 2014. The Swiss National Bank has backed the currency with Mag 7 stocks. When the Chinese bubble popped in 2015, institutional investors were instructed to load up on stocks - or else. Can Trump do the same?

Shorting into the hole is a terrible idea. The first hedge fund that gets liquidated will elicit a Fed/ Treasury response (look at the resumes of Trump's team).

This bear market needs a well-thought out strategy. To paraphrase Tolstoy, "all bull markets are alike; each bear market is unique in its own way".

By the time this is over, Nvidia (NVDA) will own all of the top 10 spots.

Gold

Gold is up 52% from its October 2023 bottom, yet almost nobody cares.

The S&P 500 making new highs once a week is news, but gold hitting ATHs every week isn't - even though gold has outperformed the S&P over this period!

January 29, 2025

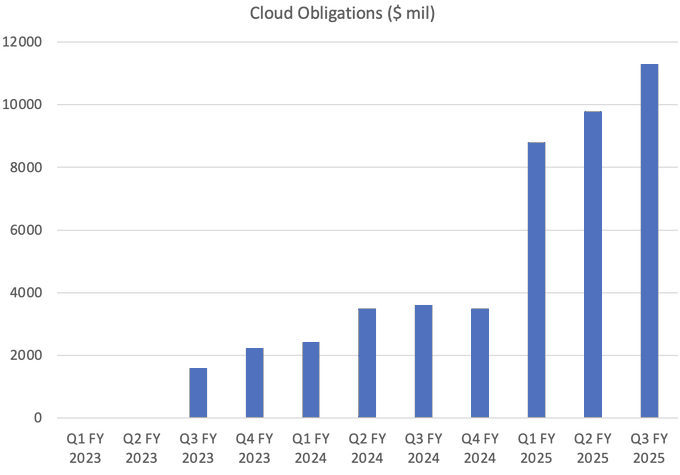

Anatomy of a round tripping scheme

1. NVDA pours equity into an AI startup

2. The startup uses the cash to purchase GPUs

3. Nvidia then commits to buying time on the machines (cloud obligations, an off-balance sheet liability for Nvidia)

4. Startup raises additional equity/ debt funding on the strength of this commitment

5. Repeat step 2 to infinity

A more complicated loop - Microsoft (MSFT) purchases the Nvidia GPUs, gets equity stakes in AI cos in return for cloud credits.

Like Enron with its SPEs, Nvidia has to keep funding these startups to keep the flywheel turning.

Trump tariffs

China should welcome Trump tariffs.

In Q1 2020, the US was entering a recession but Trump got to blame it on covid and unleash a massive stimulus.

If China is entering the debt deflation trap, a la 1990s Japan, tariffs are a great way to deflect blame onto external actors.

The PBoC can do its best, but the currency will tend to naturally appreciate as credit contracts. Unfortunately, there are no easy trades to express this view.

You could buy Ping An Insurance, SGD, Chinese banks, or the popular Chinese ETFs, but they aren't a pure macro trade.

The signal here is in what to avoid, rather than what to buy.

January 30, 2025

What will happen to NVDA GPU prices once VCs pull the plug on AI?

The dotcom bust offers a clue. While e-commerce companies like Pets dotcom and Webvan were completely worthless, hardware based projects like Motorola's Iridium had some commercial value.

Iridium planned to blanket the Earth with low earth orbit satellites, to ensure mobile phone connectivity even in the remotest of locations.

They spent $6 billion building out their impressive network, only to end up in bankruptcy as there was no demand for their services.

Why? Because regular telecom operators offered better connectivity cheaper. And - Iridium optimized for remote locations but didn't work properly in cities because of interference from tall buildings.

If you wanted to use Iridium phones in NYC, you had to lug a big briefcase out onto the pavement and stand clear of the building to make a call. Naturally, the product was a bust, even though Motorola spent $6 billion on it.

Nvidia has supplied chips to about 30k AI startups, all of them building the big, lumbering Iridium version of AGI.

Does it matter what training data DeepSeek AI used? The product is practically free. Stargate can spend $500 billion and come up with a marginally better product, but the economics of monetising it, when there's already a 'good enough' product on the market that can be run from your laptop, makes it a poor value proposition.

You can bet VCs up and down Sand Hill road have figured this out already and are scrambling to cut their exposure.

NVDA has booked $186.7 billion in revenue in the last 3 years. Even if only 50% of that is real, that's $93 billion worth of chips hitting the secondary market when these companies fold.

As for Iridium, it was plucked out of bankruptcy for $25 million, or 0.4% of sunk costs.

A similar fate awaits Nvidia GPUs once the selling frenzy kicks off.

Retail investors, oblivious to the disruptive innovation that killed the AI bubble, are buying every market dip and providing exit liquidity for institutions.

The AI crisis will not be contained.

(As an aside, whatever happened to CoreWeave? They were supposed to IPO at a $35 billion valuation in Q1).

Like what you read? Get more exclusive content by subscribing to my premium newsletter!

Good Trading!

Kashyap

Comments