Red Flags in Nvidia Q2 Accounting

- Aug 28, 2023

- 5 min read

Updated: Jan 30, 2025

This article was originally published on Twitter

NVIDIA (NVDA) filed its last quarter's Form 10-Q today. If you have been as surprised by the share price action and the (unaudited) published financials as I have been, this thread is for you.

Let's get into it.

First, what's up with the wild revenue beat ($13.51 bn reported vs $11 bn forecast)?

And how did the company achieve this without a corresponding increase in cost?

To answer these questions, we need to understand the company's revenue recognition policy.

The highlighted part, taken from last year's Form 10-K, is key.

NVDA recognizes revenue from product sales only after the product has been shipped (transfer of control).

However, license and services revenue is recognized as and when the company incurs its cost. The huge jump in revenue is almost entirely data center driven. Because that's classified as a service, the company recognizes revenue regardless of the contract's payment terms.

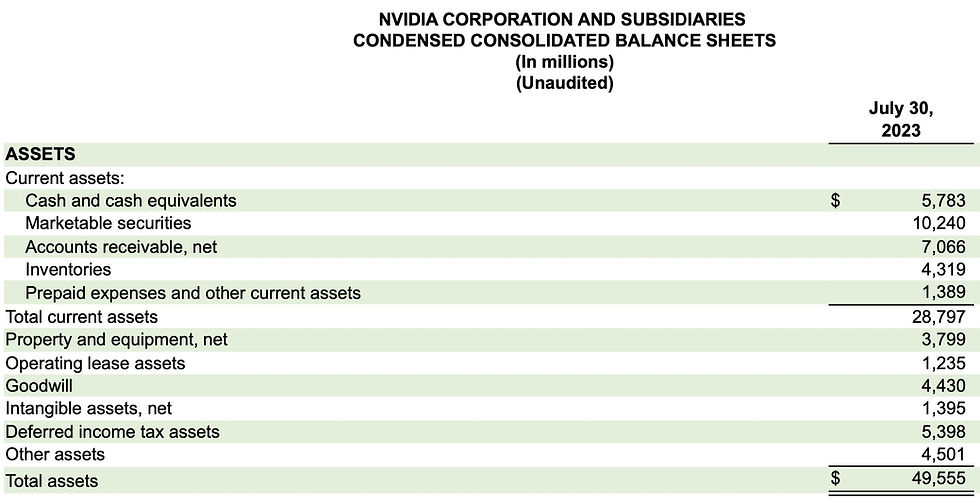

When revenue is booked but the payment has not been received from the client, the company records this as 'accounts receivable' on the balance sheet. If my hypothesis is correct, there should be a jump in receivables correlating with the revenue increase.

Unsurprisingly, that's exactly what we see. Receivables went up from $4080 mn to $7066 mn. From Q1 to Q2, receivables went up by $2986 mn as revenues increased by $6315 mn. That's 73% growth in receivables for 88% growth in "revenues".

And the growth in receivables would have been even higher if not for a $1.25 bn pre-payment. Adjusting for that prepayment, receivables would have grown 104%.

This clears up two mysteries. Costs didn't rise commensurate with revenue because the revenue isn't hard dollars but an accounting fiction. And cash didn't come in because from the clients' side, the services haven't been rendered yet and the bill isn't due.

There's another red flag here, and that's the concentration of revenue.

“Our estimated Compute & Networking end customer demand is concentrated among several large CSPs and consumer internet companies. Most of these large companies do not purchase directly from us but often purchase through multiple system integrators, distributors, and channel partners. We expect this concentration trend will continue”.

The company isn't kidding when it mentions this as a risk factor.

“A large cloud service provider, or CSP, which primarily purchases indirectly through multiple system integrators and distributors, is estimated to represent approximately 22% and 19% of total revenue for the second quarter ($2971.54 million) and first half ($3932.81 million) of fiscal year 2024, respectively, and was attributable to our Compute & Networking segment”.

This customer sure loaded up on NVDA products, working up from $961.27 million in Q1 to $2971.54 million in Q2, an increase of 209% q-o-q.

“One data center distributor customer represented approximately 17% and 13% of total revenue for the second quarter and first half of fiscal year 2024, respectively, and was attributable to the Compute & Networking segment. There were no customers with 10% or more of total revenue for the second quarter and first half of fiscal year 2023”.

39% of Q2 revenue and 32% of first half revenue came from just two customers, of which one is a distributor.

In effect, the company pulled forward demand from future quarters. Not to mention the concentration risk as well.

Then there's the very creative "sale" of goods with the express intent of inflating revenues.

To what avail? These financial shenanigans might be legal, but one has to wonder what NVDA gets out of it. Probably it was forced to do so by significant shareholders looking for exit liquidity.

And here again, we can find clues if we dig into the 10-Q. Specifically, the very weird approach to share buyback.

After no buybacks in Q1, the company went on a rampage, vacuuming up supply and fueling the short squeeze that began after its Q1 earnings release.

Maybe I'm reading too much into it? It could just be normal buyback activity after all. Well then, is this also normal?

"From July 31, 2023 through August 24, 2023, we repurchased 2 million shares for $998 million ($499 per share avg) pursuant to a Rule 10b5-1 trading plan"

From July 31 to Aug 24, the ONLY time shares traded at $499 was on Aug 24, when it traded as high as $520 pre-market. For the company to average that price, all the buying must have been concentrated on August 24.

The company released results after the close on 24th. Make of it what you will.

I have been in finance since 2016 and I've analyzed thousands of companies. I've literally never seen financial shenanigans on this scale by a trillion dollar company. Heck, nobody has!

The NVDA bubble appears to have been cleverly orchestrated to fool algos trading off headlines, suck in unwary traders, and create massive exit liquidity for significant shareholders. John Law couldn't have done this any better. I've never felt better about my short position.

Addendum

August 30

"Across nearly 330 mutual funds benchmarked to the S&P 500 or a similar index, only 15% held an above-index weight in Nvidia, according to a Morningstar analysis of the funds' most recent regulatory filings. Among those funds that held a below-average weight in Nvidia, 85% underperformed the index so far this year, Morningstar's data showed".

Now the benchmark isn't even the SPX, it's NVDA. They say the markets don't ring a bell at the top, but I can sure hear it clanging loudly.

NVDA is a bargain at a 2024 forward PE of just 28. So $60 bn in sales and $44 bn in net income? You can't make this stuff up.

NVDA CFO Colette Kress sold $2.3 mn worth of stock on Monday. This is on top of the $2.5 mn sold on May 30. Those were the only two sales this year. I must admit, I think she's as good as Nancy Pelosi in her market timing.

September 02

Jen-Hsun "A New Computing Era Has Begun" Huang exercised a big wad of stock options on Friday and immediately proceeded to cash out for approx. $117.2 million. Nothing to see here folks.

September 07

But the trend continued, with the SEC commenting on inadequate disclosures yet again, in their financial statements filed for the very same year.

The reason there's so much discussion on NVDA revenues, customers, cost of goods sold, etc is because the company hasn't disclosed enough to put these arguments to rest.

I've answered numerous [real] questions providing more clarity on everything I've outlined in this thread.

Unlike the sell-side analysts schmoozing with management, I'm NOT PAID to do this. Something to ponder while reading their pathetic straw man rebuttals and snide comments.

October 27

Update: The US govt has shut NVDA off from the Chinese market, including through intermediaries that route sales via the Middle East and Vietnam (but not Israel). The rule went into effect on Oct 23, which means Nvidia gets to inflate sales numbers for yet another quarter and fool the algos.

CoreWeave founders have cashed out, sticking Fidelity and JPM wealth clients with the losses from the unravelling of their exit scam. The sell-side analysts who helped hype the stock will get a big fat Christmas bonus for their efforts.

Comments