The Case for Gold, II

- Dec 20, 2016

- 3 min read

Updated: Jan 23, 2023

Originally published in TDV December 2016 issue

Since I last wrote “The Case for Owning Gold”, much has changed in the gold market. It seemed in August as if gold was going to break through $1400 and scream higher. Everybody was talking about the gold miners. And suddenly, the bottom fell out of the market and gold is currently languishing at $1130.

Price action aside, have the fundamentals changed? Every point I mentioned in the previous article still holds true. On top of that, we have had additional events that make gold ownership more compelling.

The War on Cash in India (and potentially elsewhere) which started on Nov. 8th. This reinforced the wisdom of holding savings in gold rather than Indian rupees. Confidence in a fiat currency only gets built up by prudent government and central bank actions. Once that confidence goes for a toss, it is hard to win back. In economics, we define inflation as an increase in the supply of money, but hyperinflation (or crack up) as a loss of faith in the currency. The moves by the Indian government post Nov. 8 th have only served to reinforce the loss of faith in the Rupee. The government has already indicated that it is coming after your gold, and there are rumours about of a ban on gold imports, which have been officially denied.

As a fan of the book and TV series Yes Minister, I go by the dictum that one should never believe something to be true until it has been officially denied. Hence, at current prices, this is a great opportunity to load up on gold. The downside is merely a price decline; the upside is having something of universal value with no counterparty risk, to serve you in case the War on Cash takes an ugly turn for the worse.

It is better to be prepared for a Category 5 Hurricane and have to go through a Category 2 one than the other way around. Prudence dictates gold ownership for long-term wealth preservation.

Second, EU Break Up: Vaffanaculo is Italian for ‘fuck off.’ Which is exactly what Italians want to do from the EU and the euro. Italy is one of the founding members of the EU, so this is a big deal. The continued concern over the EU’s break up has left a cloud of uncertainty overhanging the euro, the world’s second most important reserve currency. Although, unlike the UK, and maybe more like Greece, Italy’s departure could be a net positive for the union. Either way, these types of events tend to be unpredictable, and since the Italian banks are so weak at the moment, gold could easily be a beneficiary of the country’s departure.

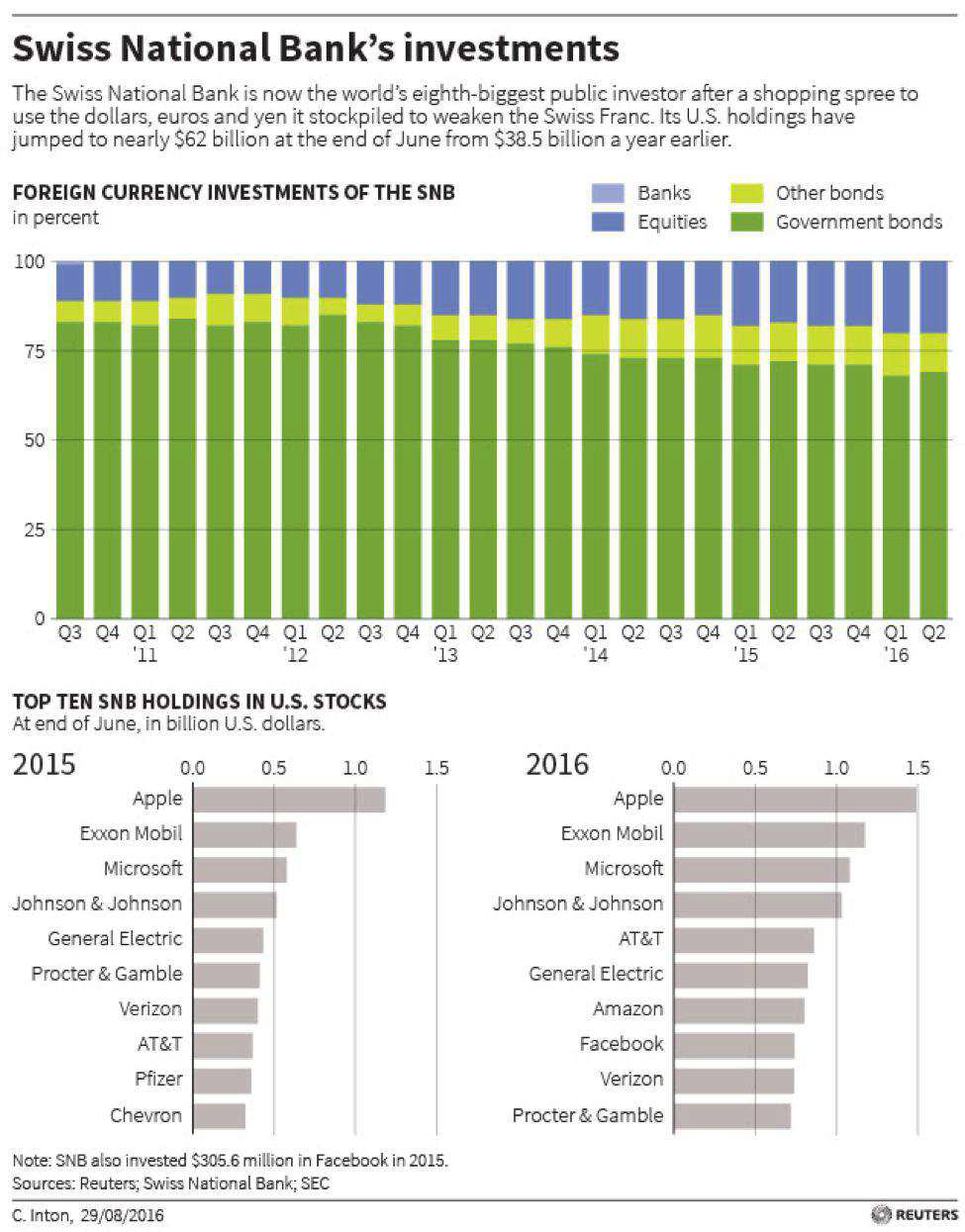

Third, the Bank of Japan still continues on its journey towards owning the Nikkei 225, as if cornering the JGB market wasn’t enough.

As a classic exhibit in the madness of crowds, the SNB doesn’t want to be outdone by the other central banks. It now owns more shares in Facebook than Mark Zuckerberg. And many of them gold shares!

With such compelling reasons for gold ownership, why is the price of gold getting whacked?

In a word: the USD!

The consequences of central bank madness is that investors are piling into the US dollar, the so-called safe haven. It also helps that US treasuries yield more than that of EU countries and Japan. It helps even more that the US stock market is dilly dallying around all-time highs, supposedly reflecting the strength of the US recovery and the rosy Trump pro-business era coming soon. The recent strength of the USD is mostly on the chatter related to rising interest rates, helped by the fact that the Fed’s monetary insanity is exceeded by the ECB.

Looking at the bigger picture, though, the USD is as doomed as the Euro and the Yen. There is no way out of their QE ZIRP trap without causing massive liquidations of the malinvestments that

they have engendered.

We already witnessed in small-scale popping of a bubble when oil prices tanked and the shale oil boom turned into a bust.

As Ludwig von Mises said:

“The boom cannot continue indefinitely. There are two alternatives. Either the banks continue the credit expansion without restriction and thus cause constantly mounting price increases and an ever-growing orgy of speculation – which, as in all other cases of unlimited inflation, ends in a “crack-up boom” and in a collapse of the money and credit system. Or the banks stop before this point is reached, voluntarily renounce further credit expansion, and thus bring about the crisis. The depression follows in both instances.”

The Fed, as with the other central banks, is damned either way. When the market realizes this, the USD will break. And when it does, our patience in owning gold will be duly rewarded.

Comments