Monthly rollup | May 2024

- Jun 3, 2024

- 27 min read

Updated: Jun 30, 2024

Stocks Mentioned: Microstrategy (MSTR), Gasoline (UGA), Hecla Mining (HL), Lundin Mining (LUN.TO), Ivanhoe Mines (IVN.TO), Patterson-UTI (PTEN), Southern Copper (SCCO), Great Lakes Dredge & Dock (GLDD), Bumble (BMBL), Gladstone Land (LAND), Roblox (RBLX), Wallbridge Mining (WM.TO), International Seaways (INSW), D/s Norden (CPH: DNORD), Flex LNG (FLNG), Gamestop (GME), DHT Holdings (DHT), Solana (SOL), Tidewater (TDW), Talos Energy (TALO), Parex Resources (PXT.TO), i-80 Gold (IAUX), General Mills (GIS), Westshore Investment Terminals (WTE.TO), Grayscale Ethereum Trust (ETHE), Neo Performance Materials (NEO.TO), Hudbay Minerals (HBM), Avalanche (AVAX) , Marvell (MRVL), Danaos (DAC), Global Ship Lease (GSL), Arm Holdings (ARM), Nvidia (NVDA)

To sign up, send me an email at hello@kashyapsriram.com I am offering discounted pricing while I build out the website. If you subscribe now, you can lock in this pricing for subsequent renewals.

Two reports are currently live in the Members Area:

The first report introduces my trading style and its evolution over my 8 year journey in finance.

The second report is a way to play the nickel story. I highlight two small cap nickel stocks that I believe offer attractive upside.

Subscribers to the free blog will continue to receive updates on current open trades. If you have bought the recommended gold & oil stocks, or bonds, or shorted Nvidia, rest assured I won't leave you hanging.

Highlights

May 01, 2024

Crude Oil

Reuters:

"Hedge funds and other money managers sold the equivalent of 95 million barrels in the six most important petroleum futures and options contracts over the seven days ending on April 23. Sales were the fastest since October 2023 and take the two-week total to 119 million barrels, according to reports filed with ICE Futures Europe and the U.S. Commodity Futures Trading Commission. The combined position was cut to 566 million barrels (49th percentile for all weeks since 2013) from 685 million (66th percentile) on April 9, as the war risk premium evaporated."

Even after all the selling, the uptrend is still intact. With momentum fading, offshore drillers are looking particularly attractive.

MicroStrategy Trade Update

Microstrategy (MSTR) longs are now hurting. Since the move began, the PoC (most popular price) is $1660 while the VWAP is $1280. The share price is down 50% from its peak, but more importantly is now below the cost basis of most bagholders.

Is this still a good time to be short? Absolutely. The crash is just beginning.

FOMC Takeaway: Operation Twist 2.0 is here

"Beginning on June 1, reinvest the amount of principal payments from the Federal Reserve's holdings of agency debt and agency MBS received in each calendar month that exceeds a cap of $35 billion per month into Treasury securities to roughly match the maturity composition of Treasury securities outstanding".

Bond are getting bid as the market digests this.

Sell gasoline (UGA) at ~$70.92

I'm taking profits ahead of today's FOMC. The refinery stocks have lost momentum, as has mostly everything in the oil space. Speculative interest is waning. While that's not stopping me from being long select oil stocks, I see no reason to hold gasoline until the start of summer driving season. A lot can happen in the span of 2-3 weeks with the Fed and BoJ wreaking havoc in the market.

There's a reason I'm closing so many trades of late. I have come around to the view that the Fed will cut rates and end QT and/or resume QE at this meeting. The core portfolio, where I'm long based on the fundamentals and TA, remains untouched. I'm exiting the smaller, higher-risk speculations and side bets on inflation. I sold Hecla Mining (HL), Lundin Mining (LUN.TO), Ivanhoe Mines (IVN.TO) and Patterson-UTI (PTEN) today, booking sizable wins in everything but Patterson-UTI. I'm also buying bonds with a tight stop, because I suspect short-term rates have peaked. And bottom-fishing sugar via the CANE ETF.

I want to be mentally prepared for a regime change and have cash to take advantage of whatever move is coming. This is with regards to my stock and futures accounts.

The crypto account is almost fully invested now. I wish I had started two weeks later, but that's always the case. Can never catch the tops and bottoms - unless you're a liar, then you can do so 100% of the time.

TA-wise, bitcoin is in bear territory. I'm 0% invested in bitcoin. My crypto portfolio is mostly ethereum and solana, with smaller allocations to avalanche, injective, polygon and arbitrum, and even smaller allocation to the high risk stuff. I'm invested in coins with good fundamentals and none of the hype that has plagued bitcoin. Once the fear subsides, I suspect we will get an alt season where the quality coins shine. This portfolio has nothing to do with my macro view - this is just growth investing 101.

May 02, 2024

This chart from KKR puts the whole Mag 7 bubble in a completely new perspective. If $200B+ companies are a rarity, $3 trillion worth companies are a historical aberration. The bursting of this tech bubble is going to bring active management back with a vengeance, as capital rotates out of the falling mega caps back into real, growing businesses that have suffered under the tech mania.

I used to joke that value investors could buy a 6 PE stock growing at 10% and have it turn into a 3 PE stock growing at 10% because it wasn't a tech company. This will change once the tech bubble craters.

The demise of the Mag 7 bubble is going to be very, very good for stock pickers.

May 03, 2024

Southern Copper

Southern Copper (SCCO) switched its dividend policy. Instead of the usual hefty cash dividends, the company will now pay a stock dividend for Q1, amounting to $1.2 per share (4.2% dividend yield).

This unusual policy implies one of two things:

(1) the company is short on cash - not true, they are already printing money and copper is going vertical

(2) the company considers the share price to be overvalued and would rather pay in shares than cash - I concur

My rolling bubbles thesis from the December 2023 macro outlook is playing out. Copper miners have become the new momentum stocks. Let's see how long this lasts.

Buy Bonds, Wear Gold

Buying bonds was a low risk/ high reward trade, an asymmetric setup. The Fed didn't cut, but the move in yen helped bonds. Treasury buybacks and lower Fed QT + Operation Twist 2.0 helped, the jobs report really helped.

Even if not, bond futures had little volatility and very skewed positioning, making it a good contrarian trade.

May 06, 2024

The yen trade got closed for a 2.5% stop loss. I added the bond trade instead, which I've covered in this video with Jason below

My Nasdaq short position got stopped out earlier today on the move above the previous high.

Band squeeze breakouts are a reliable indicator, but Apple's 8.5% after-hours move bucked the correction in the Nasdaq. I believe the market is wrong on Apple but I'm not trading my views here. Closed this trade for a loss of 1.64%.

The gold and corn trade are still working and I'm long. I closed the crude oil position at $79.28 for a profit of 10.4%. Crude is now technically a short but I'm not too keen on that, given the overall inflationary macro environment.

I'm currently long:

December Corn

June Gold (intend to roll)

5Y and 10Y Notes (intend to roll)

Calls on 2Y Notes (intend to close before expiry this month - current gain is 108.33%)

I'm short crude oil at $78. I had a sell stop in place which got executed on Friday. I'm not keen on the trade, but apparently when I did my analysis I thought this was a good idea. And the technicals indicate crude is heading temporarily lower, as does hedge fund positioning data.

I dislike getting stopped out of high conviction trades and I hate taking trades that go counter to my liking. But given how much leverage futures offer, TA and portfolio risk management are significantly more important than what I feel about any single trade, even though I'm a discretionary trader.

In an environment where bonds perform, can crude go down? Absolutely. So the positions do make sense, even though I am in the stagflation camp.

I'll end with this disclaimer: I started trading futures actively in May 2022. So, I have less than 2 years of trading experience in this market. I started with a purely fundamental approach and that is no longer the case. My current style reflects 2 years of learning how to manage risk - I'm sure it'll look very different as the account grows and I gain more skill at looking at trades on the portfolio level rather than individually.

May 07, 2024

Stalking sugar futures for an entry point. The union strike at Wilmar's Australia sugar mill, which represents over 50% of Australia's sugar production, is just starting to become mainstream news. This will be a bottom fish, but considering how other agricultural commodities have started moving, I think a bottom fish here isn't a terrible idea.

Note the absolute collapse in volatility, which is something I absolutely love to see on a chart.

The downtrend is still pronounced on the weekly chart, so beware. If you put on this trade, set a tight stop. Maybe 2 ATR on the daily, which is 91 cents, and comfortably below the low of $18.97 established on April 25th.

Corn has turned up

Wheat has gone wild

Soybeans are catching up

Sugar is likely to be next. I could be wrong, but trading is taking shots and sticking to the winners while cutting the losers. I trade futures; I don't invest in them.

New trade added to futures portfolio: July sugar at $19.52

Trailing stop at $18.76

Sell Great Lakes Dredge & Dock (GLDD)

We bought this as a pure spec. The market is now giving us a good exit. I'm taking it. Sell at the current price of $9.32.

May 08, 2024

Bumble (BMBL)

Bumble went public in Feb 2021 at $43/sh, raising $2.15B at a valuation of $8.3B. Shares now trade at $10.18, a decline of 76%. Revenue increased 16.4% YoY to $1.05B (1.24x P/S). Debt is serviceable from operating cash flows.

RSI bottomed and turned higher (divergence). OBV indicates selling pressure persists. Volatility indicators (BB width, ATR) are at troughs, i.e. nobody cares.

The company reports earnings today after the close and is expected to turn a profit.

Would you buy this stock?

Gladstone Land (LAND)

Gladstone Land announced Q1 2024 NAV of $18.5 per share, an increase of 8.1% YoY. Shares closed at $13.05 yesterday, a discount of 30%. The company will pay a monthly distribution of 4.66 cents. The share price is in a slump but the long-term outlook still looks great.

May 09, 2024

Roblox (RBLX)

Roblox investors are dearly paying for buying the Metaverse hype. There's still more pain to come. The stock trades at 5.6x 2024 sales. The company expects to post a net loss of $1.1B, or 5.5% of current market cap, has a debt to equity ratio of 100x (!), and is priced at 314 times book value.

The bursting of this tech bubble is going to be epic. Thank the Fed's 2020 money printing for getting valuations all the way past the stratosphere.

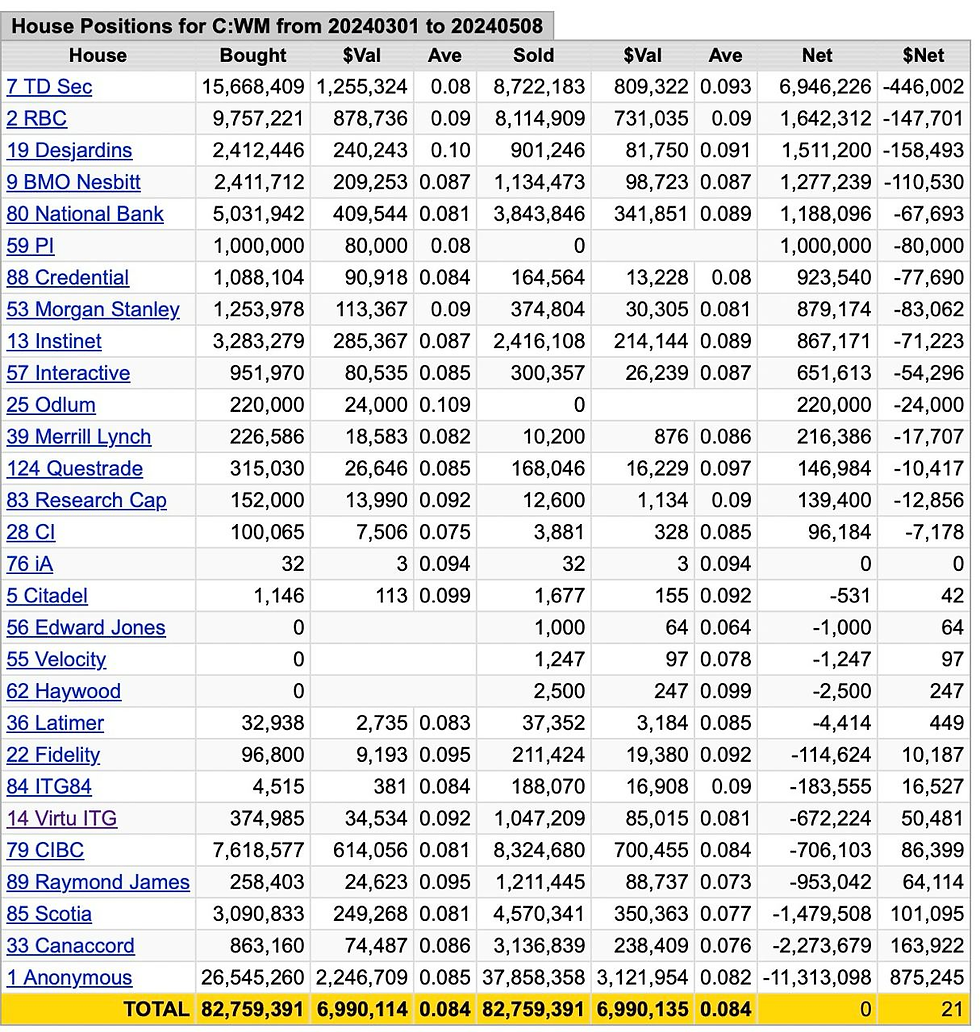

Wallbridge Mining (WM.TO)

Added to my Wallbridge Mining position yesterday. We've seen steady buying since the March bottom. I have been keeping an order at the bid for a week without getting hit - buyers are hitting the offer and creeping up the share price. I did the same yesterday, making this a 0.9% position. I had a 1% allocation earlier but my account size grew, so all I've done now is top up.

May 11, 2024

As a trader, every morning I tell myself, "I am powerless over market direction."

As an analyst, I look at stocks, commodities, crypto, fx, and try to figure out where prices are headed. I want to be right in my analysis.

What I do differently is incorporate the price action into my fundamental analysis. That makes money as a trader, and makes me have a better grasp of the fundamentals that are relevant to the price action.

I had a long conversation with Jason of AAO Research yesterday. We started out talking about agriculture and how he approaches ag futures both as a trader and as a consultant to farmers. We spoke about the Fed and my view on why they will cut rates this year, and ended with a discussion on gold miners' fundamentals and how I incorporate price action into forming my fundamental views.

I highly recommend listening to the whole thing.

After watching this, I feel so much better about my BMBL position. Not because I think your AI will date other people's AI, but because Whitney relinquished the CEO role in January.

Bumble is now run by the former CEO of Slack, and is still valued at less than 2/3rds of what Blackstone paid for the company in 2019.

Bumble is a GARP stock - one of the few remaining in the tech space where nobody bats an eye at a valuation of 20x sales.

May 13, 2024

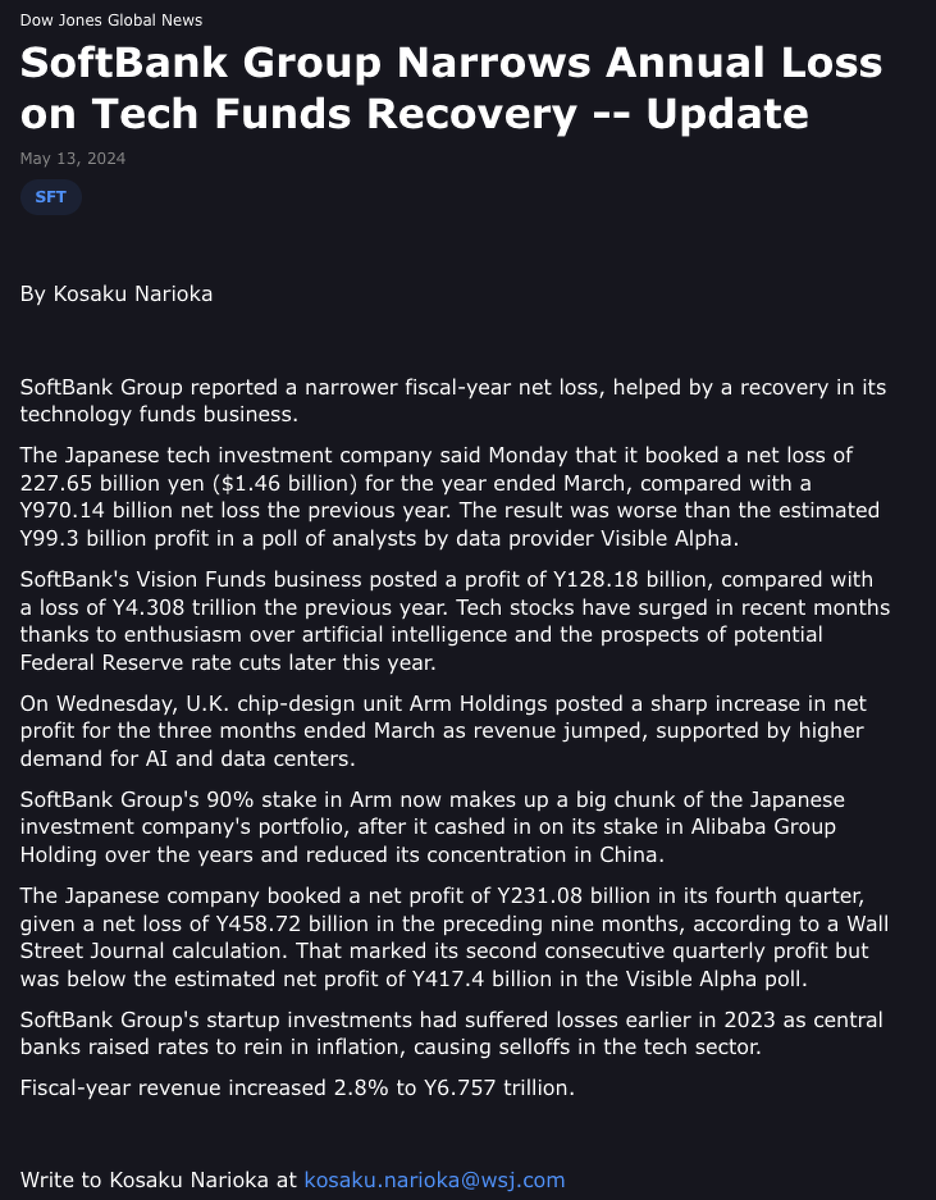

SoftBank

SoftBank results were worse than expected, but the stock is holding up above the 100 DMA, no doubt helped by ARM's timely announcement of an AI chip.

SoftBank's implosion is like watching a train wreck in slow motion. You know the outcome, but you just don't know how many frames are left before you get there.

Friday's conversation with Jason prompted me to add Soybeans to my futures portfolio. The bull case is not as clear for soybeans as it is for corn and wheat, but the setup still looks good. The primary trend is up, and I like ags because we're in a stagflationary environment and the ags haven't yet caught up to the rest of the commodity complex.

D/s Norden (CPH: DNORD)

While I did say this isn't the time to add to shipping, there are exceptions. D/s Norden trades at a PE of 4.8. The company operates 542 vessels across dry bulk and tankers, is well managed and highly regarded by shipping analysts. Nobody cares because it doesn't have a US OTC listing.

TA-wise, it looks like the stock is finally waking up from a long slumber party. I have a full position.

Flex LNG (FLNG)

I'm interested in Flex LNG as well because it has my favorite setup. But the fundamentals on gas carriers is kinda iffy right now due to overordering of vessels and slowing LNG demand during the summer months. Small position for now - I always buy band squeeze breakouts regardless of how I "feel" about the stock.

May 14, 2024

ARM IPO Unlock -Kashyap Sriram

The biggest show since GameStop turned out to be GameStop (GME) again, relegating the ARM saga to the 2 spot.

The market value of Softbank's 90% stake in Arm is now worth 40% more than Softbank itself. Reminds me of Palm/3Com and how that top ticked the dot com bubble. Only difference - SoftBank likely goes under if Arm goes down to fair value.

What's the fair value of a company with $3.2B in revenue and $300M in net income? If fellow bubble stock NVDA (37x sales and 76x PE) is the benchmark, Arm's valuation range is anywhere from $22.8B to $118.4B. Arm shareholders better hope the tech bubble continues forever and Softbank never seeks to unload its massive 90% stake.

The stock still isn't shortable. Short interest is just 8% of float, but daily volumes are low except for the days it squeezes.

And so, the standoff continues.

(The third biggest show is the Archegos trial. SoftBank's lawyers are likely paying close attention).

DHT Holdings (DHT)

Oil tanker company DHT Holdings reports earnings today. Considering how the other tanker stocks have reacted to earnings, it is likely DHT goes up 5-7% on the news. Earnings have been particularly strong for shipping companies in Q1, helped by the Red Sea situation and low water levels in the Panama canal. Earnings should come down in Q2 (seasonality) and pick up again sometime in Q3.

If I'm wrong and the algos sink DHT on its earnings release, it'll be a good entry point for a long-term position.

Sugar Futures Trade Update

Stopped out on sugar at $19.05. The trailing stop saved 29 cents, which I can now add to my risk budget for second attempt. That'll be once this downtrend at least shows signs of ending.

May 15, 2024

2 months later, copper did go to $5/lb. I think this is as far as it goes for now.

This is why I'm short-term bearish and even have a crude oil short in my futures portfolio. Positioning is swinging wildly and is being exacerbated by every bit of news on inventory build. Oil can consolidate for another couple of months, driving the momentum traders out, before resuming its uptrend.

Copper Futures Calendar Spread Trade

Copper has gone vertical on short covering.

The calendar spread is now deeply negative, at 20 cents on the July/Sep spread. Once the short covering is done, that should tighten up. Trade idea: buy the calendar spread for a credit of ~$500 per contract on the mini-copper futures.

Hedge funds and other money managers have increased their short positions in Nymex WTI futures and options by 16%, marking the fourth straight weekly decline and reducing the net length held in the benchmark contract to 117,651 contracts, the lowest since February.

The spread has narrowed to 11.25 cents now. Looks like the copper squeeze is over.

May 16, 2024

Sprott's Copper Caper

They say no one rings a bell at the top but the bell is ringing loud and clear.

Copper is up 47% from the October lows and Sprott wants to squeeze copper like they did uranium. With the LME alone holding a billion dollars worth of copper in inventory, not to mention all the shadow Russian inventory, the Chinese inventory, and annual mine production of 22 million metric tonnes, good luck succeeding.

This is a good story to sell to the Sprott brokerage clients, but that's about it. Chances are, the fund trades at a permanent discount to NAV just like their physical gold and silver funds.

CPI Points To Stagflationary Environment

The CPI came in hot for yet another month. The market went up. That's how we know we are in a stagflationary environment. I got stopped out on a few short positions. Everything I owned went up yesterday, but of course I had to focus on what didn't work in my favor (and that's also the question everyone asks).

I questioned myself on why I bother having a short book in the first place, and had to go back to my January notes and look at what got stopped out then. Which was: NEM, GOLD, FCX, CF, HP, AR, CHK, PTEN, RIG, and a few others. A long list of names in sectors that I'd eventually ride to good gains ytd. The returns on the miners look great if you just see the YTD number, but the first 2 months were volatile and it was hard to get positioned for the move. The short positions met a CPI day that triggered stops, which was no different from what happened in January on the long side.

I've become semi-famous on Twitter for calling out NVDA, SMCI, MSTR, ARM etc. which gives people the impression I'm short everything all the time. It's just that nobody cares when I write about Bumble, gold miners, copper, oil, Chinese stocks, bonds and banks. The visibility on social media is good for business, but trading-wise it makes no difference. I was having a conversation about this with a friend yesterday on how we handle wearing our trading hats and our writing hats. It's really two different worlds.

Bigger picture: everything is going up.

Dare I say it at the risk of jinxing it?

"Cash is trash." - Ray Dalio

It's one of the most painful yet true comments. Painful because having money in the bank gives me a sense of security. True because inflation is rapidly eroding the value of cash.

Incidentally, the crashes during the Weimar hyperinflation actually ended up wiping out speculators who were on the right side of the trend, but got the timing wrong.

Those little blips on the log chart hide massive corrections on a linear chart. Even the 1970s stagflation had corrections along the way, most notably from 1974-76 when it looked like the economy had righted itself, only to reverse and enter a second phase of accelerating inflation that culminated in the blow-off top in silver.

Shorting Copper Miners

I went short 3 copper miners - FCX, SCCO and HBM - yesterday. Copper has gone parabolic but the calendar spread has eased. I expect a momentum drop. This is a mean reversion trade which I expect to hold for a few weeks. SCCO has much lower production than FCX and a much higher market cap.

HBM went up 10% on Tuesday. The chart looks like a blow-off top.

While FCX hasn't run as hard, it is also weaker and more cyclical. Note the negative OBV.

Futures portfolio update

I've rolled over the 10Y and Gold contracts. I'm still mulling whether to roll over the 5Y or switch to the 2Y, given the higher roll cost on the 5Y. I'm still watching for a buy signal in sugar. Once it starts, I expect it'll move rapidly and catch up with the rest.

The Solana Trade - Riding Winners and the Power of Trend Following + Fundamentals

Solana (SOL) flushed from $210 to $115, a 45% correction, then held that low and has now started its next leg up. Solana has had plenty of corrections all the way up from $8 (FTX crash low) to $210. I believe Solana still offers the best risk/reward among all the large caps. Journalists and crypto investors are spilling more ink over a 4-5x move in Bitcoin than the incredible 26x move in Solana.

Bitcoin went up on ETF hype and liquidity flows. Solana is going up because crypto natives are actually using the network. And the network is getting an upgrade which will make it even faster. I highly recommend learning about Firedancer.

Solana is cheap because FTX had a lot of Solana in their treasury and the FTX crash took Solana down to $8, down 96.9% from the last cycle peak of $260. We've all heard stories of how $1 invested in Amazon, Microsoft, Apple etc. after the dot-com bust would have multiplied. Those gains happened for betting on the right stock. These are unusual opportunities.

Weekly chart of Solana

The FTX overhang still persists. The FTX estate is planning to sell 41.1M Solana at $60 to institutional investors. No doubt several palms were greased when the lawyers came up with this brazen scheme to loot the exchange's victims.

Think of Solana as a company emerging from bankruptcy, with an overhang of creditors' shares and warrants weighing the share price down even as cash flow accrues to equity holders. I liken it to Tidewater (TDW), which was actually in that situation.

So you have a top 5 coin

with a $72.6 billion market cap (vs. competitor ethereum with a market cap of $361.6B)

deeply depressed due to the FTX crash

staying depressed due to games being played by the FTX estate

with a massive upgrade (Firedancer) in testing

and nobody cares

even though it is up a lot more than bitcoin and isn't driven by liquidity flows but by other factors.

My original entry in Solana was as a trade at $11.78 in Jan 2023. I cut the trade in February for a quick double, but kept watching for a re-entry. Which we got in June 2023 on SEC FUD and news on Robinhood de-listing. I have been adding to my position since then. A lot in the $60-$80 range. Slightly less in the $100-$140 range.

I've talked about Solana a lot but never really made a comprehensive case for why the risk/reward is unique among crypto and why it deserves a bigger allocation than bitcoin or any other large caps. This post should correct that. Hit me up with any questions and I'll answer them in the group.

One last point on Solana. The staking yield is 7.6% APY. This provides a boost to the total return, and more importantly given crypto volatility, provides income. Selling bitcoin at the lows crystallizes losses, making them permanent. Taking out a portion of staking rewards merely halts the compounding. Solana is an easier long-term HODL than bitcoin, which is yet another factor the buy-and-hold crowd ignores.

$100 invested in Solana, with and without staking yield. The power of compounding.

May 17, 2024

Talos Energy (TALO)

Took a starter position in GoM oil producer Talos Energy. As the weekly chart shows, all the volatility has been wrung out.

Mexican billionaire Carlos Slim has been adding heavily to his position. He owns 19.5% of the company. Institutions own 77.2%. Average daily volume is 1.7 million shares, which is just $20M at a $12 share price. This is a $2.2B market cap company. There is nothing wrong with the company, it is just that the market doesn't care. As much as I enjoy the game of trading, I like to sock away some stocking stuffers when the downside is limited. It is just one more strategy in my toolkit.

The Colombian peso is strengthening against the dollar, indicating a healthy economy.

Parex Resources (PXT.TO)

The largest independent oil E&P in Colombia.

The stock had a nasty fall and has recovered, holding the 50 and 100 SMA. I like oil E&Ps for the long-term. I like what I see with the peso. This is Calvin's pick (owner of Marhelm, a shipping and energy data provider) who has done boots on the ground research in Colombia.

Sometimes, it is that simple. I own Parex Resources at C$24.42 and am looking to add on a close above C$25.

May 20, 2024

Shorting Copper Futures

The copper short squeeze continues this AM, with the July contract rising to nearly $5.2/lb. The open interest on the July contract is 161k, dropping to 79.3k on the September contract and even further to 42.2k on the December contract. If the funds short the July contract decide to roll and take the loss - much smaller now since the spread has collapsed - the drop in open interest alone is sufficient to prick this bubble.

There is no shortage of the metal in inventory. The problem is just US sanctions on Russian metal. The physical commodity traders are skilled at arbitrage, they will figure out how to profit from the short squeeze.

I see chatter on FinTwit about how copper can continue to go parabolic. The recent move in cocoa has really warped traders' perception on parabolic runs. Psychologists call it availability bias. If you take a step back, it is easy to see that parabolic runs are the exception rather than the norm.

The run in cocoa was fuelled by an actual supply deficit which still remains. That's not the case with copper. Yes, there is a looming supply deficit in copper this year, but this parabolic move is driven by the sanctions on Russian metal and a short squeeze in the July contract, not actual fundamental reasons. If fundamentals were behind the move, you'd see the calendar spread turn positive - i.e. the September contract priced above the July contract and the December contract priced above September, etc. That's not what we see here, lending credence to the idea that this is just a good old short squeeze.

How to play this? The contrarian idea of shorting July copper is a terrible, terrible idea. Without knowing who is caught short, the size of their losses, or other specifics which I'm not privy to, I wouldn't touch that contract long or short.

The September contract is a different story. If the shorts roll over, they lose approx. 5.5 cents/lb, which sure beats getting squeezed and taking further losses. By rolling over, they will be covering the July short and initiating a short on the September contract. That would take the pressure off and end the short squeeze.

While fundamentals support a $5 copper price, this price action doesn't. When this reverses, it'll reverse as fast as it went up.

I'm short September copper futures at $5.079 with a stop at $5.337 (3-ATR stop). Copper will have to squeeze another 5% to take me out, which can happen, but I'm betting on the physical commodity traders resolving this situation before that happens.

As with the calendar spread trade, the goal is not to be right, but to take risk when I'm paid to take risk.

i-80 Gold (IAUX) Breakout

Took a while, but i-80 Gold has bottomed and turned higher.

May 21, 2024

Futures portfolio update

Added the September 2Y contract (long) and intend to sell the 5Y contract before expiry. I'm not rolling over the short crude oil position. Crude is stuck in a range so there's no point being in this trade. Besides, I'm using this weakness to add to my favorite energy names.

New buy yesterday: General Mills (GIS)

Long time readers know I've always been a fan of staples. I've recommended GIS and B&G Foods before, but not put on a staples trade in nearly 8 months now. With utilities and staples at 52-week highs, it's time for another attempt.

I'm keeping it simple and buying GIS. This is a sector I want to own as the Fed lowers rates. Anyone who traded the 2018-19 period remembers how these stocks became bond proxies. It looks like something similar is happening now.

Nestle has had all the volatility sucked out of it and the stock is above the 50 DMA

Indian equities are never cheap, but Nestle India is holding the 50 week moving average. At a mere 74 PE, it is only twice as expensive as Nvidia.

India is a land where PE ratios don't matter. The central bank is printing money and has imposed capital controls, forcing investors to bid up whatever asset they can get their hands on. There's now an activist movement aimed at preventing Indian subsidiaries from remitting "excessive" royalties to their parent entity. Not because the RBI doesn't have the dollars, but because it isn't "fair" to local shareholders. For now, it's party on and there's money to be made. Getting it out is a whole other ball game.

Westshore Investment Terminals (WTE.TO)

I have added Westshore Investment Terminals, a coal terminal operator, to my watchlist.

Westshore operates a coal storage and unloading/loading terminal at Roberts Bank, British Columbia. Westshore’s operating revenues are primarily derived from rates charged for handling coal which is loaded onto seagoing vessels. It is the largest coal export terminal in Canada, handling 33 million tonnes annually. Westshore is the terminal of choice for Canadian coal mines and for United States mines in the Powder River Basin of Montana and Wyoming.

The stock is cheap at a PE of 15x, price to book of 2x, and debt-to-equity ratio of 0.6x. The Jim Pattison Group - a Canadian conglomerate/ investment holding company - owns 45.4%. Institutions own 19.4%. The stock is illiquid and at 52-week lows, so this is on the watchlist but not a Buy until the price action changes.

Ethereum ETF Approval

This [my Grayscale Ethereum Trust (ETHE) recommendation] is the fastest I've ever had a trade work.

(cue song)

May 22, 2024

Band squeeze breakout in Neo Performance Materials (NEO.TO) - coinciding with the Q1 earnings release and gathering steam on the announcement of US tariffs on Chinese magnets.

I love to see fundamentals and technicals align.

Hudbay (HBM) Announces Capital Raise

Hudbay Minerals announced a US$300M equity financing (10% of current market cap) at $9.5/share, with a 15% overallotment option. Given where the share price is trading at, they did a very, very smart thing. More miners should be smart about taking the cash now, especially after the long drought in funding.

Trading Thoughts

This has been quite the busy week with a lot of new trades. And it's only Wednesday. As a solo trader, I take opportunities when I get them, which is very different from a fund, where you have to allocate whenever capital comes in and can't sit on cash waiting for opportunities. Some weeks see a lot of activity, some weeks are more relaxed. With Nvidia reporting earnings today, this promises to be a long week for me.

Avalanche (AVAX)

Avalanche has moved out of its horizontal channel, signalling a move higher is underway. Avalanche's unique multi-chain approach makes it my third favorite crypto infrastructure play, after Solana and Ethereum - in that order.

May 23, 2024

"Our next chart shows the level of unrealized losses on held-to-maturity and available-for-sale securities portfolios. Total unrealized losses declined 30.2 percent quarter over quarter to $477.6 billion as mortgage and Treasury rates declined in the fourth quarter. Lower unrealized losses on residential mortgage-backed securities drove the improvement, accounting for about two-thirds of the quarterly decline in unrealized losses on securities. Though it remains elevated, this level of unrealized losses is the lowest reported since second quarter 2022." - FDIC Chairman Martin Gruenberg, March 2024 (yes, the same guy who just resigned)

I went over why I'm bullish financials along with bonds in this discussion with Jason (skip to minute 18). Today's price action hasn't changed my view.

You just cannot have a banking crisis or a bond market sell-off during an election year.

Stopped Out on Marvell and Parex Resources

Marvell (MRVL) hit my buy stop right at the open for a 10% loss. Everything in tech is catching a bid following Nvidia's earnings.

Stopped out on Parex Resources (PXT.TO)

I bought on seeing the stock hold the 50 and 100 DMA. I stopped out when it dropped below the 50 and 100 DMA. I have no strong conviction on the stock, so when the technicals turn, I'm out. With Talos Energy (TALO), my other oil E&P bottom-fish, I'm accumulating on weakness because I understand the value there.

Systems traders employ multiple trading systems. I employ multiple trading strategies.

Reminiscences of a Stock Operator

Today's euphoria led me to re-visit one of my favorite sections from Reminiscences of a Stock Operator. It's the only book I re-read, because with each read I gain more wisdom. This section is with regards to a stock that was being artificially propped up, and how he broke the pool operators who were manipulating it. Whether it is the copper short squeeze or the Nvidia gamma squeeze, all these artificial moves which are unsupported by the fundamentals eventually end. Something to keep in mind while the whole financial world is going bonkers over a company committing accounting fraud.

"I have to do my own seeing and my own thinking. But I can tell you after the market began to go my way I felt for the first time in my life that I had allies -- the strongest and truest in the world: underlying conditions. They were helping me with all their might. Perhaps they were a trifle slow at times in bringing up the reserves, but they were dependable, provided I did not get too impatient. I was not pitting my tape-reading knack or my hunches against chance. The inexorable logic of events was making money for me. The thing was to be right; to know it and to act accordingly. General conditions, my true allies, said "Down!" and Reading disregarded the command. It was an insult to us. It began to annoy me to see Reading [a blue chip stock] holding firmly, as though everything were serene. It ought to be the best short sale in the entire list because it had not gone down and the pool was carrying a lot of stock that it would not be able to carry when the money stringency grew more pronounced. Some day the bankers' friends would fare no better than the friendless public. The stock must go with the others. If Reading didn't decline, then my theory was wrong; I was wrong; facts were wrong; logic was wrong. I figured that the price held because the Street was afraid to sell it. So one day I gave to two brokers each an order to sell four thousand shares, at the same time. You ought to have seen that cornered stock, that it was sure suicide to go short of, take a headlong dive when those competitive orders struck it. I let 'em have a few thousand more. The price was 111 when I started selling it. Within a few minutes I took in my entire short line at 92. I had a wonderful time after that, and in February of 1907 I cleaned up". - Reminiscences of a Stock Operator by Edwin Lefevre, loosely based on Jesse Livermore's life story.

May 24, 2024

DAC and GSL go parabolic (again): what now?

Two of our containership stocks have gone vertical. It's a good problem to have. Question is: where to set your stop? I use two methods - a 3 ATR (14-day) and PSAR, both shown on the charts below. The dotted line is the PSAR, the solid line is the ATR stop.

Danaos (DAC)

Global Ship Lease (GSL)

Alternatively, if you are an investor, you can let them ride for 1-2 years for a double from current levels. I first spotted DAC when it was $4 a share in 2020 and ignored it. I was focused on tankers back then. But this is a trading service, so I recommend trailing stops on all positions.

May 25, 2024

I knew ethereum had outperformed bitcoin since inception, but didn't realize the magnitude of that outperformance until I read this article. BNB has been just as successful, rising from 15 cents to $600, a 4000x return.

If you spend this entire crypto bull market just talking about bitcoin and not making money, congrats, you're no different from the medieval serf who didn't venture beyond his village boundaries for fear of dragons.

An article I highly recommend reading for anyone in crypto

May 28, 2024

Closed the copper futures short position for a gain of 5.81%.

This was a counter-trend trade. The short squeeze is over, the trend is up, and while copper may have further downside my trade has performed as intended and I'm now done. I still have the short positions in copper miners SCCO, FCX and HBM, as well as a long position in copper explorer Solaris Resources (SLS.TO), which I talked about when I issued the Sell recommendation on Anglo American (AAL.L).

Covered the remaining 2 technical shorts - ADSK and DASH today for a small gain, offsetting the loss on MRVL getting stopped out. Momentum in tech continues to be strong, so I covered these and took a shot at Arm Holdings (ARM). I've been itching to short Arm - a company that's more richly valued than Nvidia.

The momentum is so insane, shorting here is no different from bottom fishing Talos Energy (TALO). It's a really good entry, but with the risk of going against me really quickly. Some would say avoid trades like these. I take these shots but with discipline, in the form of a strict stop loss and avoiding re-entry, or death by a thousand cuts. The copper short was one such trade that worked, which is also why I'm looking for another such trade. I'm in my groove, making this the opportune time to try more risky trades.

When my hot streak ends (and it inevitably will), I'll be happy to sit with my fundamentals-driven trades in trending stocks and sectors.

Short ARM with a 3-ATR stop, which is 14.7% above my entry.

May 29, 2024

May 30, 2024

Luxury group Capri Holdings CPRI Q1 results

- Versace revenue of $264M decreased 3.6% on a reported basis and 2.9% on a constant currency basis driven primarily by softening demand globally for fashion luxury goods.

- Jimmy Choo revenue of $137M decreased 9.3% on both a reported and constant currency basis driven primarily by softening demand globally for fashion luxury goods.

- Michael Kors revenue of $822M decreased 9.7% on a reported basis and 9.2% on a constant currency basis. The decline versus prior year was primarily attributable to softening demand globally for fashion luxury goods.

Seems like there's a pattern here.

Appetite for luxury is waning even among the 1% of the 1%. Below chart is the Rolex Market Index. No surprise that prices peaked at the beginning of the Fed hiking cycle.

"Nvidia-backed CoreWeave"

It's all over the news. An open secret. Yet, NVDA still refuses to mention CoreWeave in their quarterly filings or highlight the related-party transactions.

Nvidia has:

an equity investment in CW

revenue coming from CW

expenses in the form of data center credits with CW

accounts receivable from CW

inventory and purchase commitments to fulfill future orders from CW

WireCard slipped up by announcing they had done a shady deal in India. That mistake shined a light on their accounting fraud.

Nvidia has been careful not to slip up, but more people are starting to make the connection.

CoreWeave was supposed to IPO this year. You'd think the founders and all the Sand Hill suits would jump at the chance to bail out early, but have instead postponed the IPO to 2025. There must be a very, very good reason for not cashing out in a hot AI market.

I smell panic.

May 31, 2024

In Closing: A satirical version of Nvidia's business plan

We sell GPUs to data center customers, booking sales in the P&L and accounts receivables on the balance sheet. We then turn around and commit to purchasing data center capacity from said customers, and agree to buyback "sold" inventory, making sure contract specs stay under the lease reporting threshold so we can book the sales. Customers use these deals and obtain bank financing on depreciating inventory - since receivables are unsecured, these CDOs rank higher in priority, making it safe for the banks. Besides, we've also equity funded these customers, so the LTV seems modest. (The customers also raise capital from third parties, so they are not technically our SPVs. The equity layer is risky, but it is no different from the risks taken by the big Wall Street banks when they bought mortgages to package into MBS. As long as they are smart enough to offload the shares in the secondary market to Fidelity HNWIs or other rich rubes with wealth management accounts, and further offload risk by gamma squeezing Nvidia higher with call options, the risk is minimal. Besides, the guys doing these deals are the same players who orchestrated the sub-prime bubble. They know how to play the game). We can keep doing this - beating revenue estimates each quarter and raising guidance - as long as we can keep finding these SPVs. CoreWeave, Lambda... the newest one doesn't even have a name - it is just a hexadecimal string in a Mauritius corporate registry. At some point, we will announce a temporary hit to gross margins as we phase out Grace Hopper/ H100/ Blackwell in favor of The New, New Thing, clean up the balance sheet, and then resume playing the game. Wall Street will understand and overlook The Big Bath, a tried and tested accounting technique used whenever a company makes "a transition plan". By then, Nvidia will be too well established as a $10 trillion company with impeccable Wall Street cred (we'll make sure to give the investment bankers some financing business with fat fees), and these pesky Twitter accounts would have given up trying to parse our 10-Qs. Like Jack Welch, our CEO will ride off into the sunset before the whole scheme unravels. By then, we may even get a government bailout because we're Too Big To Fail. Good luck shorting our shares. This is a foolproof plan and we will get away with it. Sincerely, The League of Extraordinary Conmen |

Good Trading!

Kashyap

I like these! Great stuff. Jason P